What is the state of the hedge fund industry? In the July 2015 draft of their paper entitled “Hedge Funds: A Dynamic Industry In Transition”, Mila Getmansky, Peter Lee and Andrew Lo review recent academic research on hedge funds and update industry performance statistics. They surmise that hedge fund data from 10 years ago may be unrepresentative of today’s environment, especially in the aftermath of the 2007-2009 financial crisis. Their review considers four perspectives: investor, portfolio manager, regulator and academician. Based on this review and self-reported hedge fund performance data during January 1996 through December 2014, they conclude that:

- Over the specified sample period, the annualized mean return across all funds based on raw (self-reported) data is 12.6%, but adjusting for survivorship bias and backfill bias cuts this return to 6.3%. These biases are much stronger in older data, making raw trend data deceptive.

- On average, hedge funds do not meaningfully outperform a traditional 60%-40% stocks-bonds portfolio. However:

- Hedge funds generally exhibit low volatility.

- Reallocating 5%, 10%, 20% or 50% from the traditional portfolio to a “typical” (average, monthly-rebalanced) hedge fund suppresses volatility more than return, boosting risk-adjusted performance by about 13%.

- Hedge funds with very high return autocorrelations strongly exploit an illiquidity premium, while those with very low autocorrelations limit drawdown during market crashes.

- Intensive hedge fund industry competition fosters rapid innovation and drives attrition, to the benefit of nimble and risk-tolerant investors but the stress and financial loss of naive and inattentive investors.

- The number of (self-reporting) hedge funds peaks in 2007-2008. The attrition rate in 2008, when 71% of hedge funds lost money, is 21%.

- The number of funds declines markedly since, especially during 2012-2014, with the 2014 attrition rate a record 26%.

- The unconstrained investment environment of hedge funds fosters great breadth of choices and unique depth of expertise, but it complicates risk management. Measuring and managing hedge fund risks requires thorough understanding of underlying strategies and sophisticated analysis.

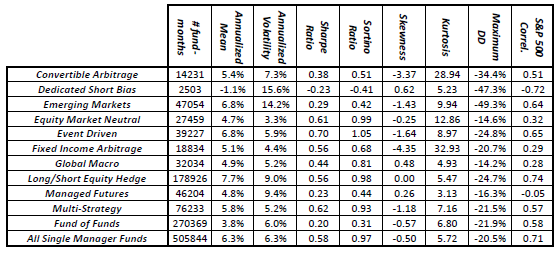

The following table, extracted from the paper, summarizes average, bias-adjusted statistics for (self-reported) net hedge fund returns by investment style and overall during January 1996 through December 2014, including: number of fund months in the sample; annualized mean return; annualized return volatility; annual Sharpe ratio; annual Sortino ratio; annualized skewness; annualized kurtosis; and, maximum drawdown (DD). The risk-free rate is the three-month U.S. Treasury bill yield. The overall “All Single Manager Funds” category excludes funds of funds.

Results show that performance across categories is diverse, average returns are not extraordinary, and volatilities are generally low.

In summary, the body of research indicates that the hedge fund industry is diverse and currently very dynamic in terms of fund turnover, often offering low-volatility return streams that can diversify a traditional stocks-bonds portfolio.

Cautions regarding conclusions include:

- As noted in the paper, the “typical” hedge fund is conceptual, not investable. Investor experience depends on specific hedge fund(s) selected.

- Many investors may lack the sophistication for judicious hedge fund selection.