Are Morningstar mutual fund profiles accurate? In their October 2019 paper entitled “Don’t Take Their Word For It: The Misclassification of Bond Mutual Funds”, Huaizhi Chen, Lauren Cohen and Umit Gurun examine whether aggregate credit risks of actual of U.S. fixed income (corporate bond) mutual fund portfolios match those presented by Morningstar in respective fund profiles. They focus on recent data (first quarter of 2017 through second quarter of 2019), during which Morningstar includes percentages of fund holdings by risk category. Using Morningstar profiles, actual holdings as reported to the SEC, detailed credit ratings of holdings and returns for 1,294 U.S. corporate bond funds during January 2003 through June 2019, they find that:

- While funds report accurate detailed holdings to Morningstar, Morningstar uses only accompanying summary risk distributions when assigning funds to risk categories.

- Summary risk distributions are on average safer than those of actual holdings. Among funds with mismatches between summary and actual risk distributions, summaries shift 99% (1%) to lower (higher) risk categories.

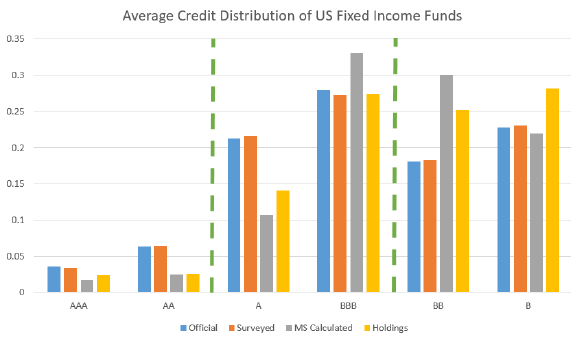

- In recent data (see the chart below):

- Morningstar assigns about 30% of funds to safer categories than justified by publicly reported holdings.

- Almost half of funds in the safest categories are overrated.

- Overrated funds have higher average yield and 0.1% higher average quarterly return than other funds in the same Morningstar risk category, and thereby on average:

- Receive 0.34 more Morningstar stars.

- Have a higher probability of positive flows from investors.

- Charge 10% higher expenses.

- When categorized instead based on actual holdings, overrated funds underperform true peers by an average 0.1% per quarter.

- Miscategorization in summary risk distributions is stronger among funds with several quarters of large negative returns and among certain fund families (listed in Table 9 of the paper).

The following chart, taken from the paper, summarizes average quarterly credit risk categories of U.S. corporate bond mutual funds from the first quarter of 2017 through the second quarter of 2019 across four calculation methods:

- Official – as assigned by Morningstar from summary reports provided to Morningstar by fund managers.

- Surveyed – as replicated from fund manager summary reports as a test of Morningstar accuracy in processing them.

- MS Calculated – as Morningstar would have assigned them based on detailed fund holdings provided to Morningstar by fund managers.

- Holdings – as Morningstar would have assigned them based on detailed fund holdings as reported by fund managers to the SEC.

Morningstar credit quality ratings are: AAA and AA for high quality; A and BBB for medium quality; and, BB and B for low quality. Notable points are:

- Morningstar accurately processes credit risk distribution summary reports provided by fund managers.

- However, detailed holdings indicate considerably lower credit quality than summary reports. In other words, summary reports in aggregate overstate the safety of U.S. corporate bond mutual funds.

In summary, evidence indicates that investors should verify Morningstar mutual fund risk categories when using them to screen U.S. corporate bond funds, with special attention to certain fund families.

See also Morningstar’s response to the study, which disagrees with key findings.

Cautions regarding findings include:

- Focus should perhaps be on a subset of fund families with inflated summary reports rather than on average behavior of all funds in the sample.

- Analysis of fund performance metrics in addition to returns may be illuminating.