Are managed futures programs good portfolio diversifiers? In his September 2012 paper entitled “Revisiting Kat’s Managed Futures and Hedge Funds: A Match Made in Heaven”, Thomas Rollinger updates prior research exploring the diversification effects of adding managed futures to traditional portfolios of stocks and bonds and to portfolios including stocks, bonds and hedge funds. His proxies for the four asset classes are: (1) for stocks, the S&P 500 Total Return Index; (2) for bonds, the Barclays U.S. Aggregate Bond Index; (3) for hedge funds, the HFRI Fund Weighted Composite Index; and, (4) for managed futures programs, the Barclay Systematic Traders Index (focused on systematic trend-following strategies). He assumes monthly (frictionless) portfolio rebalancing. Using monthly returns for the four asset class indexes during June 2001 through December 2011, he finds that:

- Compared to the hedge fund index, the managed futures index has lower mean return and higher standard deviation of returns. However, the managed futures index has positive instead of negative return skewness (tendency for upside rather than downside surprises) and much lower return kurtosis (smaller tail effects).

- The correlation between hedge fund (managed futures) index returns and stock index returns is 0.80 (-0.15), and that between the hedge fund index and the managed futures index is 0.10.

- Managed futures are more effective than hedge funds in suppressing return volatility of a portfolio of stocks and bonds, without undesirable side effects on skewness and kurtosis.

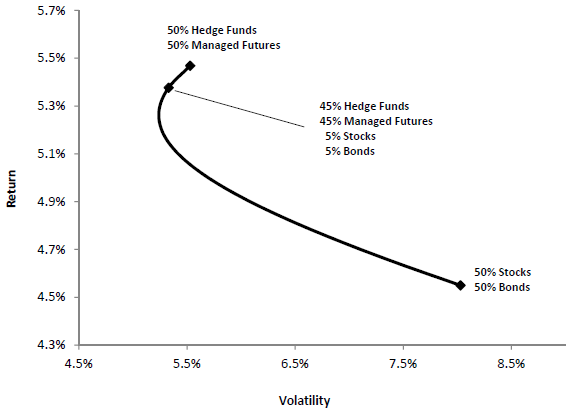

- In general, as portfolio allocations to hedge funds and managed futures increase, gross mean return increases, volatility decreases, skewness increases and kurtosis decreases. Aggregate allocations of 70%-90% to hedge funds and managed futures, with 45%-70% to managed futures, generate optimal combinations of gross return statistics (see the chart below).

- Results are robust to substitution of other managed futures indexes.

The following chart, taken from the paper, plots gross annualized average return versus annualized standard deviation of returns for a set of portfolios with allocations ranging from 100% stock index and bond index (equally weighted) to 100% hedge fund index and managed futures index (also equally weighted) during June 2001 through December 2011. Underlying calculations assume monthly rebalancing to target allocations. Shifting allocations from stocks-bonds to hedge funds-managed futures consistently improves gross average return and mostly reduces volatility over this sample period.

In summary, evidence from the past decade confirms prior research indicating that a managed futures index diversifies stock and bond indexes more effectively than does a hedge fund index.

Cautions regarding findings include:

- Use of indexes to represent asset classes ignores trading frictions and management fees associated with fund creation and maintenance. Including such costs would reduce reported returns.

- The paper ignores trading frictions (and potentially trading restrictions) associated with monthly rebalancing of asset class allocations. Frictions would reduce reported returns, and restrictions may preclude rebalancing.

- To the extent these costs/frictions differ by asset class, accounting for them may affect findings.