How has the marketplace for exchange-traded funds (ETFs) evolved? What performances do its “species” deliver? In their January 2021 paper entitled “Competition for Attention in the ETF Space”, Itzhak Ben-David, Francesco Franzoni, Byungwook Kim and Rabih Moussawi summarize evolution of broad-based ETFs (tracking broad market and style indexes) and specialized ETFs (tracking sectors and narrow investment themes). They apply a 4-factor model of stock returns (accounting for market, size, value and momentum factors) to assess risk-adjusted performance (alphas) of these categories. Using monthly data for 1,080 U.S. equity ETFs (ignoring non-equity, foreign equity, inverse and leveraged ETFs) and monthly 4-factor model returns during 1993 through 2019, they find that:

- Broad-based ETFs appear first, competing on price via low fees.

- As competition intensifies, offerors launch specialized ETFs, competing on thematic popularity with high fees. At the end of 2019, specialized ETFs manage 18% of sample assets but generate 36% of fees.

- Aggregate alpha for broad-based ETFs is slightly negative, statistically indistinguishable from zero.

- At launch, specialized ETFs hold popular (overvalued) stocks appealing to retail and sentiment-driven investors. Hype subsequently dissipates, and these funds in aggregate deliver significantly negative alpha in the years after launch. Specifically:

- Specialized ETFs tend to hold stocks with recent price run-ups, high (positive) media exposures, high analyst growth expectations, high market-to-book ratios and high short interests.

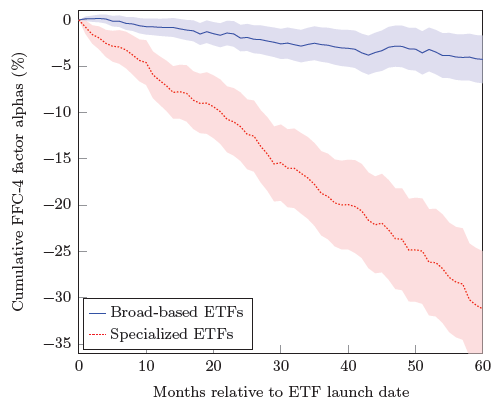

- A value-weighted portfolio of all specialized ETFs generates -3.1% net annual alpha, due mostly to new launches generating -5% net annual alpha (see the chart below).

- Specialized ETFs have a greater fraction of retail investors than do broad-based ETFs and are especially popular among sentiment-driven investors that trade on Robinhood.

The following chart, taken from the paper, tracks cumulative net monthly 4-factor alphas of value-weighted groups of broad-based (solid blue line) and specialized (dotted red line) ETFs during the 60 months after individual fund launches. Shaded areas present 95% confidence intervals. Results show that the broad-based ETFs generate modestly negative alpha, while the specialized ETFs generate materially negative alpha persistently for at least five years.

In summary, evidence indicates that cheap broad-based ETFs offer modestly negative alpha, and expensive specialized ETFs (typically launched just after peak excitement for an investment theme) offer materially negative alpha.

Cautions regarding findings include:

- Factor models of stock returns generally ignore costs of factor portfolio reformation and shorting costs/constraints, thereby overstating factor returns and understating real-world alphas of actual portfolios.

- Broad brush treatment of specialized ETF alphas may obscure some valuable narrow ETFs.