Should investors adopt a mutual fund for the long term, or should they occasionally switch to funds with fresh ideas and energy? In the July 2015 draft of their paper entitled “Milk or Wine: Mutual Funds’ (Dis)economies of Life”, Laura Dahm and Christoph Sorhage investigate whether mutual fund performance tends to decline or improve with age. They measure fund performance via four alphas: Jensen’s; three-factor (market, size, book-to-market); four-factor (adding momentum) alpha; and, five-factor (adding liquidity). All alpha calculations employ 36-month rolling window regressions of net fund returns in excess of the risk-free rate. The regression methodology allows measurement of the performance difference between a mature fund and its younger self. Using returns, characteristics and holdings data for 3,489 actively managed U.S. domestic equity funds during 1991 through 2014, they find that:

- The average fund in sample is about 13 years old with $1.1 billion under management and net monthly return of 0.71%.

- Depending on the performance measure, doubling fund age relates to a decrease in annual performance of 0.58% to 0.75%. Results imply that a typical 12-year old fund underperforms its 3-year old self by up to 1.5% annually.

- Findings are generally robust to excluding funds less than three years old and controlling for fund size and a range of other fund characteristics. However, age does not impact performance of actively managed funds focused on stocks of large, stable companies. Nor does it affect performance of equity index funds.

- Indicators of mutual fund outperformance also decline with age.

- Fund trading shrinks by up to 20% per year.

- Older funds tend to hold fewer stocks that are hard to value.

- Fund age relates negatively to Active Share.

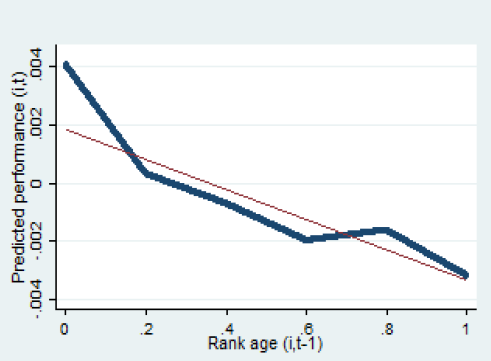

The following chart relates mutual fund monthly four-factor alpha to fund age percentile (blue line), with five groups or quintiles delineated on the horizontal axis. The red best-fit trend line indicates that fund performance tends to decay with age. Results are similar for other alphas, with results generally implying that only the lowest fund age quintile is attractive.

In summary, evidence indicates that active U.S. equity mutual funds tend to become less active as they age, and their performance therefore exhibits slow decay over time.

Cautions regarding findings include:

- The authors do not test the economic value to an investor of systematically switching to younger funds over a long investment horizon. Such switching may have tax implications.

- Findings may differ for alpha measurement intervals other than 36 months.

See also “The Outperformance of (Truly) New Hedge Funds”, “A Fresh Hedge Fund Horse Every Couple of Years?” and “New Funds Outperform?”.