Does the expanding set of exchange-traded funds (ETF) support reliable replication (cloning) of future returns for some hedge funds? In their December 2014 paper entitled “Smart Beta ETF Portfolios: Cloning Beta Active Hedge Funds”, Jun Duanmu, Yongjia Li and Alexey Malakhov test replication of top risk factor-driven (beta-active) hedge funds using portfolios of ETFs. The selected hedge funds perform well historically and are especially suited to cloning because of their dependence on known risk factors. The hedge fund selection and cloning process involves repeating four steps annually based on two years of monthly historical data. Specifically, each year the authors:

- Identify the fourth of hedge funds with returns most strongly correlated with known risk factors.

- Iterate cluster analysis 100 times to identify ETFs most representative (highest correlation of monthly returns with the mean return of the cluster) of up to 100 clusters to serve as risk factor proxies.

- Use an optimization tool on each of the 100 cluster analyses to combine representative ETFs into 100 clone models of pre-fee (risk factor perspective) monthly returns for each target hedge fund.

- Apply the Bayesian information criterion (which addresses data snooping bias via a penalty for model complexity) to select the best clone model for each target hedge fund.

They then test, starting in 2005 (when enough historical ETF data become available), the ability of winning clone models to match post-fee (investor perspective) monthly returns of target hedge funds for one year out-of-sample. They mitigate backfill bias in hedge fund returns (only funds with good starts begin publicizing their returns) by excluding the first 24 months of reported returns. They suppress survivorship bias by including funds that later stop reporting. Using monthly net returns for 2,014 hedge funds (963 live and 1,051 dead) during 1994 through 2012 and monthly returns for 1,313 passive ETFs as available during 1997 through 2012, they find that:

- During January 2005 through December 2012, the ETF-based clone portfolios perform very similarly to their risk factor-driven hedge fund counterparts. Specifically, performance metrics for the selected hedge funds (matched ETF-based clones before annual trading frictions), are:

- Average monthly return: 0.93% (0.94%).

- Sharpe ratio: 0.23 (0.22).

- Terminal value of $1.00 initial investment: $2.58 ($2.60).

- Annual reformation of clone portfolios means relatively low ETF trading fricitons.

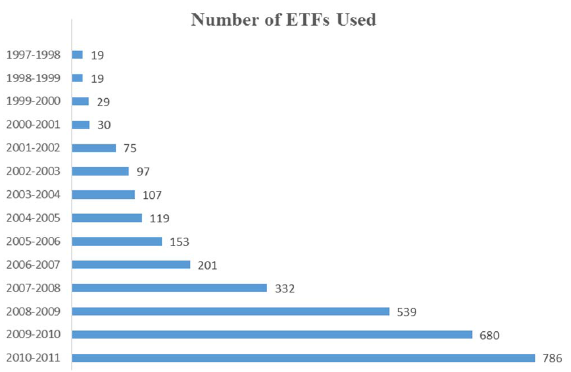

- The cloning process becomes more precise over time as more ETFs become available (see the chart below).

The following chart, taken from the paper, shows the number of ETFs used for each two-year calculation window. Out-of-sample analysis commences in 2005, when more than 100 ETFs are available.

In summary, evidence indicates that cloning the subset of hedge funds most driven by known risk factors with portfolios of ETFs may be an effective, low-cost way to mimic their superior returns.

Cautions regarding findings include:

- The methodology applied in selecting and cloning hedge funds is beyond the reach of most investors, and probably costly if delegated. Simpler ways of constructing multi-factor portfolios from ETFs may have value.

- The eight-year out-of-sample test period is not long in terms of market/economic cycles.

- As noted, the paper does not account for trading frictions associated with annual reformation of clones. These frictions would reduce clone performance. An annual reformation frequency mitigates this concern.

- There may also be data and processing costs that reduce net performance.

See also the closely related “Cloning Hedge Funds with ETFs”.