Does the expanding set of exchange-traded funds (ETF) support reliable replication (cloning) of future hedge fund returns? In their March 2014 paper entitled “In Search of Missing Risk Factors: Hedge Fund Return Replication with ETFs”, Jun Duanmu, Yongjia Li and Alexey Malakhov investigate the use of ETFs as factors in constructing hedge fund clones. They note that the number of U.S.-listed passive ETFs increases from 19 in 1997 to 1,313 in 2012, now comprising a large set of proxies for many factor/characteristic strategies. They use this set of factor proxies to clone a hedge fund via a three-step in-sample replication process based on two years of historical data. Specifically, each year they:

- Iterate cluster analysis 100 times to identify ETFs most representative (highest correlation of monthly returns with the mean return of the cluster) of up to 100 clusters to serve as factor proxies.

- Use an optimization tool on each of the 100 cluster analyses to combine representative ETFs into 100 clone models of pre-fee (risk factor perspective) monthly returns for each target hedge fund.

- Apply the Bayesian information criterion (which addresses data snooping bias via a penalty for model complexity) to select the best clone model for each target hedge fund.

They then test the ability of winning clone models to match post-fee (investor perspective) monthly returns of target hedge funds for one year out-of-sample. They mitigate backfill bias in hedge fund returns (only funds with good starts begin publicizing their returns) by excluding the first 24 months of reported returns. They suppress survivorship bias by including funds that later stop reporting. Using monthly returns, fees and characteristics for 3,190 hedge funds and monthly returns and fees for 1,313 passive ETFs as available during 1997 through 2012, they find that:

- The typical hedge fund has a 1.5% management fee, a 20% incentive fee on profits above the account high water mark, a $250,000 minimum initial investment and a 30-day redemption period.

- Over the entire sample period, the average number of factors (ETFs) selected by the optimization tool is just is 2.2, suggesting that hedge fund strategies are generally not very complex.

- In-sample and out-of-sample hedge fund replication accuracy increases with the number of ETFs available.

- During 1997-2003 (2004-2011), the average R-squared statistic between monthly in-sample returns of winning clones and their respective target hedge funds is 0.42 (0.57).

- During 1999-2004 (2005-2012), the average out-of-sample average monthly tracking error between winning clones and respective target hedge funds is -0.63% (-0.05%), with volatility 4.3% (3.5%).

- Over the entire sample period, an equally weighted and annually reformed portfolio of clones underperforms an equally weighted portfolio of associated hedge funds across multiple performance measures. However, since 2005, the clone portfolio performs similarly to the hedge fund portfolio.

- For the subsample of most accurately cloned target hedge funds (the fourth or fifth of clone-hedge fund pairs with the highest in-sample R-squared statistics), the equally weighted and annually reformed portfolio of clones outperforms the equally weighted portfolio of hedge funds out-of-sample, likely due to the lower fees of the clones and lack of hedge fund manager skill. Neither portfolio delivers conventional eight-factor hedge fund alpha.

- For the subsample of least accurately cloned target hedge funds (the fourth or fifth of clone-hedge fund pairs with the lowest in-sample R-squared statistics), the equally weighted and annually reformed portfolio of clones underperforms the equally weighted portfolio of hedge funds out-of-sample, likely due to hedge fund manager skill. While these hard-to-clone funds do on average deliver significant eight-factor alpha, they have almost 1.5 times the attrition rate of easy-to-clone funds, suggesting high hidden risks.

- Since 2005, across 12 hedge fund styles, clones on average tend to:

- Outperform six styles: Emerging Market Equity, Equity Market Neutral, Long Bias Equity, Convertible Arbitrage, Fixed Income (see the chart below) and Fixed Income Arbitrage.

- Perform about the same as three styles: Distressed Securities, Long/Short Equity and Multiple Style.

- Underperform three styles: CTA/Managed Futures, Macro, and Merger Arbitrage.

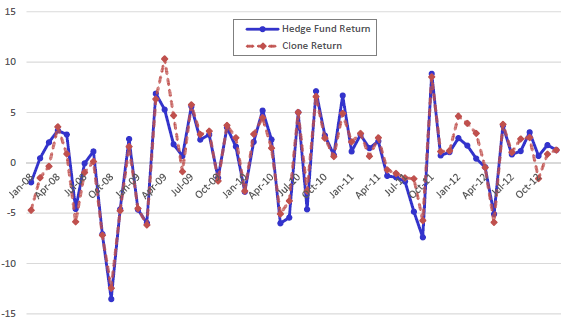

The following chart, taken from the paper, compares monthly out-of-sample performances of a clone optimized per the process described above and its target hedge fund (which has a Fixed Income style) over a five-year out-of-sample test period. Results indicate that the cloning process successfully replicates the target hedge fund in this case.

In summary, evidence indicates that the large universe of passive ETFs can serve as empirical strategy “factors” for constructing hedge fund-like portfolios (but that some hedge funds are much more difficult to replicate than others).

Cautions regarding findings include:

- The methodology applied in constructing hedge fund clones is beyond the reach of most investors, and probably costly if delegated. Simpler ways of constructing multi-factor portfolios from ETFs may have value.

- The paper does not account for trading frictions associated with periodic reformation of clones based on annual model revisions. These frictions would reduce clone and clone portfolio performance. An optimization process that considers these frictions might lean toward ETFs that are relatively liquid.

- There may also be data and processing costs.