Do currency exchange rates exhibit short-term momentum? In the April 2013 version of their paper entitled “Is There Momentum or Reversal in Weekly Currency Returns?”, Ahmad Raza, Ben Marshall and Nuttawat Visaltanachoti investigate whether exchange rate movements over the past one to four weeks persist over the next one to four weeks. They test these 16 alternative strategies (four look-back intervals times four holding intervals) by each week buying (selling) the fifth of available currencies that have appreciated (depreciated) the most against the U.S. dollar. Using weekly and monthly spot and forward prices for 63 emerging and developed market currencies versus the U.S. dollar as available during October 1997 through December 2011, they find that:

- Gross annualized returns for all 16 strategy variations are positive, ranging from 1.9% (one-week look-back/one-week holding) to 9.1% (four-week look-back/four-week holding). Corresponding gross annualized Sharpe ratios are 0.20 and 1.05, respectively.

- Appreciating, not depreciating, currencies drive strategy performance.

- Gross returns are larger before 2005, but still exist during 2005-2011. For example, the gross annualized Sharpe ratio for the four-week look-back/four-week holding strategy is 1.20 (0.88) before (after) the end of 2004.

- While present under most conditions, gross momentum is stronger during U.S. economic expansions than contractions and when currencies are generally falling rather than rising against the U.S. dollar.

- Returns are unrelated to those of carry trade strategies (buying high-interest rate currencies and selling low-interest rate currencies).

- Currency market volatility tends to depress momentum returns, with momentum weakest when volatility is high and currencies are generally falling against the U.S. dollar.

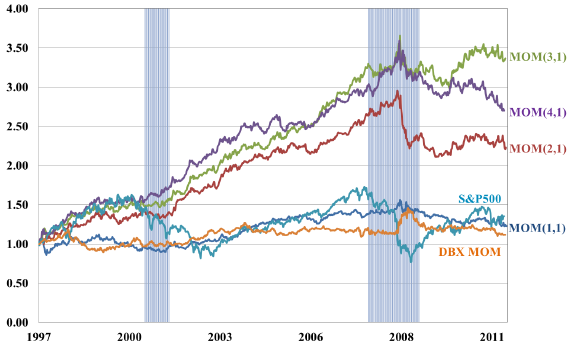

The following chart, taken from the paper, compares gross cumulative values of $1 initial investments in four of the above 16 currency momentum strategies in October 1997, and in the S&P 500 Index and the Deutsche Bank Currency Momentum Index (DBX MOM, a currency momentum ETF that is each month long the three 12-month spot winner G10 currencies and short the three 12-month spot loser G10 currencies) as benchmarks. Look-back intervals range from one to four weeks, and the holding interval is one week. For example, MOM(3,1) represents a look-back interval of three weeks and a holding interval of one week. areas correspond to National Bureau of Economic Research (NBER) contractions.

Results suggest that longer momentum measurement intervals work better than short ones, and that currency momentum does not work well during U.S. economic contractions.

In summary, evidence indicates that currency exchange rates exhibit gross short-term (one-week to four-week) momentum, most strongly for look-back intervals of three or four weeks.

Cautions regarding findings include:

- Reported returns are gross, not net. Trading frictions for weekly portfolio formation may materially reduce these returns.

- The study does not address currency portfolio leverage and capital requirements, subject to regulation and broker requirements. Anticipation of margin calls during drawdowns may require substantial idle capital.

- Testing 16 strategies on the same data introduces data snooping bias, such the the best-performing strategies likely overestimate out-of-sample expectations.