Does momentum investing work for currencies as it does for equities? In the December 2011 version of their paper entitled “Currency Momentum Strategies”, Lukas Menkhoff, Lucio Sarno, Maik Schmeling and Andreas Schrimpf investigate momentum strategies in foreign exchange (FX) markets. FX markets are generally more liquid than equity markets, with huge transaction volumes, low trading frictions and no short-selling constraints. The study’s principal analytic approach is to rank 48 currencies monthly based on returns over the past one, three, six, nine and 12 months and use the rankings to form six eight-currency portfolios for holding intervals ranging from one to 60 months. The monthly winners (losers) are the portfolios with the highest (lowest) past returns. Using monthly FX spot and one-month forward price and bid-ask data for 48 currencies relative to the U.S. dollar as available over the period January 1976 through January 2010, they find that:

- FX hedge portfolios that are long (short) currency portfolio winners (losers) generate average annualized gross returns of about 6% to 10% for the one-month holding interval. Profitability fades slowly as holding interval increases, with cumulative returns peaking at eight to 12 months and reversing thereafter (see the first chart below).

- FX momentum strategy gross profitability persists after controlling for business cycle, liquidity, carry trade (long high interest rate and short low interest rate currencies) and four equity (market, size, book-to-market, momentum) risk factors.

- FX momentum strategy gross profitability varies considerably over time and with currency characteristics. Gross returns are:

- Higher for currencies with high rather than low past idiosyncratic volatility (about 8% versus 4% annualized).

- Higher for currencies with high rather than low risk ratings.

- Concentrated (half of all profit) in minor currencies with relatively high trading frictions.

- Including trading frictions conservatively based on the full bid-ask spread lowers the average annual profitability of the best FX momentum strategy (one-month ranking and one-month holding intervals) from 10% to 4% and nearly eliminates the profit of many other strategies (see the second chart below). Both high turnover and concentration of gross returns in currencies costly to trade account for this large impact.

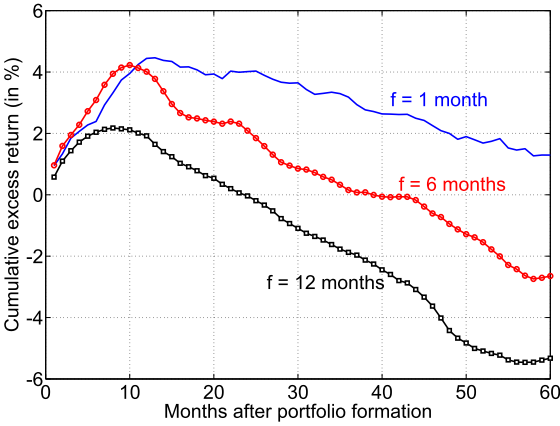

The following chart, taken from the paper, shows average cumulative gross returns during the 60 months after portfolio formation for three FX momentum hedge strategies that are long (short) winner (loser) currency portfolios formed monthly on an overlapping basis, as follows:

- f=1 month has a ranking interval of the past month (blue).

- f=6 months has a ranking interval of the past six months (red).

- f=12 months has a ranking interval of the past 12 months (black).

On average, cumulative returns increase most rapidly just after portfolio formation, peak after eight to 12 months and then reverse over longer horizons. Reversal is more pronounced for longer ranking intervals. This pattern suggests a cycle of investor underreaction and overreaction.

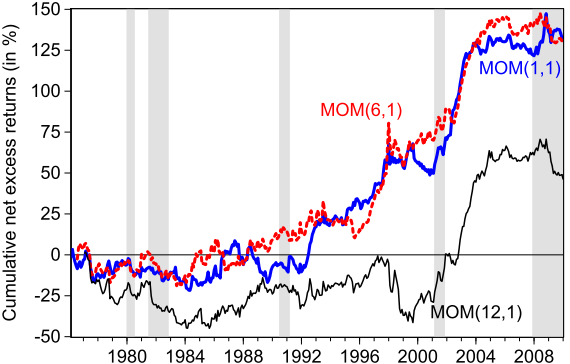

The next chart, also from the paper, shows average cumulative net returns for three FX momentum hedge strategies that are long (short) winner (loser) currencies formed monthly on an overlapping basis, as follows:

- MOM (1,1) has a formation interval of one month and a holding interval of one month (blue).

- MOM (6,1) has a formation interval of six months and a holding interval of one month (red).

- MOM (12,1) has a formation interval of 12 months and a holding interval of one month (black).

Trading frictions conservatively include full recorded bid-ask spreads. Shaded areas correspond to NBER recessions (known only retrospectively). Results indicate that FX momentum strategies are much more profitable in the last decade of the sample period and that momentum strategies do not always deliver high returns to investors.

In summary, evidence indicates that currencies exhibit momentum in a manner similar to that of stocks, but that trading frictions are a substantial barrier to consistent profitability.