Is intermediate-term asset class momentum a useful way to generate inputs (return, volatility and correlation forecasts) for a multi-class mean-variance optimization strategy? In their May 2015 paper entitled “Momentum and Markowitz: a Golden Combination”, Wouter Keller, Adam Butler and Ilya Kipnis test the effectiveness of using intermediate-term lookback intervals (1 to 12 months) to generate monthly long-only mean-variance optimized portfolios. They argue that such lookback intervals are more likely than conventional long (multi-year) intervals to provide forecasts that persist during one-month portfolio holding intervals. They name their approach Classical Asset Allocation (CAA). To test CAA, in addition to adopting the practical long-only constraint, they further:

- Select from the efficient frontier a target annualized portfolio volatility of either 10% (aggressive) or 5% (conservative).

- Forecast asset returns by averaging results from lookback intervals of 1, 3, 6 and 12 months.

- Forecast covariances (volatility-correlation relationships) from a 12-month lookback interval.

- Cap portfolio weights for risky assets at 25%, but do not cap weights for 3-month U.S. Treasury bills (T-bills) and 10-year U.S. Treasury notes (T-notes).

- Consider three universes of 8, 16 and 39 asset class proxies.

- Use equal weighting (EW) of all assets in a universe as a benchmark.

They introduce an optimizer program to streamline calculation of optimal portfolio weights. Using monthly total returns for 39 indexes spanning multiple asset classes as available during January 1914 through December 2014, they find that:

- The combination of a long-only constraint and momentum-based forecasts largely stabilizes the mean-variance optimization strategy.

- CAA consistently beats EW by a wide margin in frictionless backtests (see the charts below).

- Results are generally robust to different risky asset allocation caps.

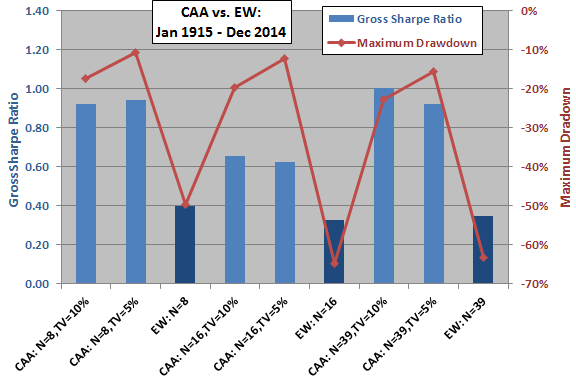

The following chart, constructed from data in the paper compares gross annualized Sharpe ratios (based on a 5% risk-free rate) and maximum drawdowns for three strategies applied to three asset universes over the entire sample period. The three strategies are: CAA with target volatility (TV) 10%; CAA with TV 5%; and, EW. The three universes consist of 8, 16 and 39 asset class proxies (indexes or portfolios).

For each universe, CAA easily outperforms EW. It appears that the gross outperformance of CAA may come mostly from avoiding large synchronized drawdowns in risky assets (multi-class crashes).

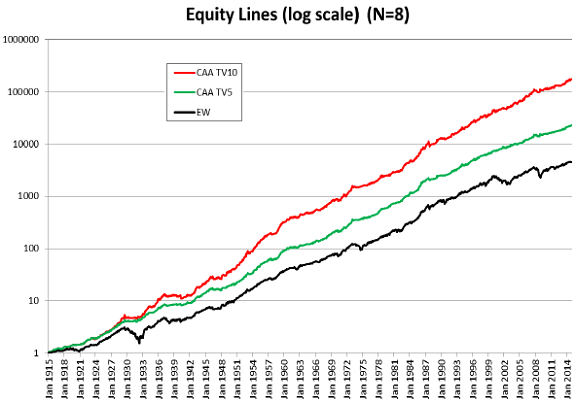

The next chart, taken from the paper, compares on a logarithmic scale cumulative gross values of $1 initial investments in the above three strategies as applied to the small (N=8) universe over the entire 100-year test period. This universe consists of total return versions of: the S&P 500 Index; a Europe-Asia-Far East equity index; an emerging markets equity index; a U.S. technology sector equity index; the Japan TOPIX; T-Bills; T-notes; and, a U.S. high-yield bond index. As described above, the weights for all assets except T-bills and T-notes may not exceed 25%.

Results confirm that both aggressive and conservative CAA portfolios beat EW by wide margins on a gross basis and that CAA outperformance concentrates during EW crashes.

In summary, evidence suggests that intermediate-term asset class momentum effectively generates forecast inputs for a long-only, multi-class mean-variance optimization strategy.

Cautions regarding findings include:

- It is not clear which aspects of CAA contribute most to gross outperformance. It may be that simpler crash-avoiding models can capture most of it.

- The costs of setting up and maintaining tracking funds for the specified asset class proxies, and the costs of monthly switching among funds, may have been very high for a large part of the sample period (see “Trading Frictions Over the Long Run”), reducing strategy performance. Moreover, if tracking funds had existed, market feedback from trading them may have affected market behaviors.

- Asset class proxy return data may not have been available in a timely manner as assumed, making a part of backtests unrealistic. A robustness test with a delay between monthly momentum calculations and portfolio formation may be informative.

- Performance of CAA relative to the benchmark EW may depend on the degree to which components of a specified asset class universe concentrate in equities (in other words, the degree of synchronization of asset class proxy crashes).

- Methods are likely beyond the reach of many investors. Delegating strategy execution to an advisor or fund would incur fees.

- Treating 10-year U.S. Treasury notes as risk-free seems problematic since the market value of such notes can vary considerably from month to month.

Review the associated stream of research in “Long-run Test of a Tactical, Tractable MPT”, “Momentum-boosted Practical Approach to MPT” and “Tactical, Simplified, Long-only MPT with Momentum”.