Is time series (intrinsic or absolute) momentum evident in international stock indexes and commodity indexes? In the June 2015 version of their paper entitled “The Trend is Your Friend: Time-Series Momentum Strategies Across Equity and Commodity Markets”, Athina Georgopoulou and George Wang test intrinsic momentum trading strategies that are each month long (short) equally weighted indexes with a positive (negative) cumulative return. They consider a range of look-back intervals for measuring cumulative index returns. They insert a skip-month between the look-back interval and index portfolio reformation to avoid short-term reversal. They consider a range of subsequent holding intervals. Using monthly closes in U.S. dollars for 45 equity indexes (25 developed and 22 emerging markets) and monthly excess returns for 22 commodity indexes during December 1969 through December 2013, they find that:

- International equity and commodity indexes exhibit significant intrinsic momentum. Specifically:

- Index monthly returns display positive autocorrelation, more strongly for equities than commodities.

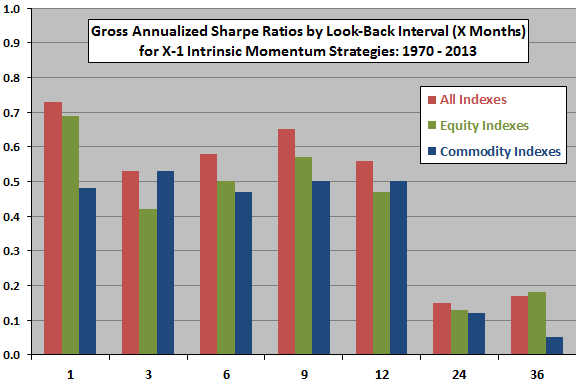

- Intrinsic momentum strategies generate materially positive abnormal returns with respectable Sharpe ratios for look-back intervals up to a year (see the charts below).

- Market, size and book-to-market factors do not explain intrinsic momentum.

- Intrinsic momentum is stronger, but constrained to shorter look-back intervals, for emerging equity markets compared to developed equity markets.

- Intrinsic momentum is strongest during extreme market movements up or down, and is therefore stronger during the second half of the sample period than the first half.

- Intrinsic momentum is not in evidence since the 2008 financial crisis.

- Intrinsic momentum strategies tend to outperform cross-sectional or relative momentum strategies that are each month long (short) the equally weighted fifth of indexes with the highest (lowest) past returns, more strongly for short holding intervals.

The following chart, constructed from data in the paper, summarizes gross annualized Sharpe ratios for intrinsic momentum strategies that are each month long (short) indexes with positive (negative) cumulative returns over different look-back intervals, followed by a skip-month. Look-back intervals on the horizontal axis are in months. The subsequent holding interval is one month for all look-back intervals. Results are similarly attractive for look-back intervals up to 12 months, but unattractive for 24-month and 36-month look-back intervals.

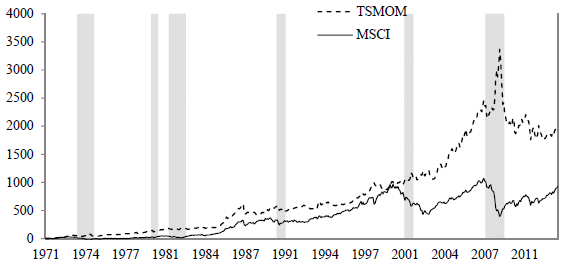

The next chart, taken from the paper, compares the trajectories of $100 initial investments in an intrinsic (time series) momentum strategy (TSMOM) and the MSCI World Index during February 1971 through December 2013. TSMOM includes all international equity and commodity indexes based on a 12-month look-back interval and a one-month holding interval (with an intervening skip-month). Shaded areas denote U.S. recessions per NBER. While generally outperforming the world equity index, intrinsic momentum has not performed well since the 2008 financial crisis.

In summary, evidence supports belief that intrinsic (time series) momentum exists and is exploitable in international equity and commodity markets.

Cautions regarding findings include:

- Use of indexes ignores the costs of maintaining investable tracking funds. These costs likely vary across indexes and would reduce reported look-back and holding interval returns. These costs could change some past returns from positive to negative.

- The study also ignores costs of periodic reformation of index portfolios. Especially for shorter holding intervals (more frequent portfolio reformation), these costs would reduce intrinsic momentum strategy performance.

- Testing different look-back and holding intervals on the same data introduces snooping bias, such that the best-performing combinations overstate expectations.

- The contest between intrinsic and relative momentum strategies may measure the degree to which the former is net long rather than compare efficacy in extracting a momentum premium. See “Relative vs. Intrinsic Past Return Reversal, Momentum and Reversion”.

See also the seminal “Intrinsic Momentum Investing”, which employs futures price data.