Has the growing role of financial investors in commodities markets (financialization) weakened performance of widely used momentum and term structure investing strategies? In his July 2014 paper entitled “Strategies Based on Momentum and Term Structure in Financialized Commodity Markets”, Adam Zaremba investigates impacts of financialization of commodity markets on the profitability of momentum and term structure strategies. His base momentum strategy is each month long (short) the half of commodity futures with higher (lower) returns over the past month. His base term structure strategy is long (short) the half of commodity futures with the largest positive or backwardated (negative or contangoed) difference in prices between the nearest and next-nearest contracts. For each commodity futures series and each strategy, he performs double-sorts on strategy parameters and the level of financial investor (non-commercial trader) participation from Commitments of Traders (COT) reports to measure the effects of financialization on strategy performance. All portfolios are equally weighted and fully collateralized. Using monthly total returns for 26 commodity futures series as available and a broad commodities index, along with position data from COT reports, during 1986 through 2013, he finds that:

- Across all commodity futures series, participation of non-commercial traders (financial investors) increases from 23% in 1986 to 45% in 2013. Financialization varies, however, across series (from 20% for rice to over 50% for natural gas).

- For the base momentum strategy (1-month ranking interval) over the entire sample period:

- Average gross monthly return in excess of that for a broad commodities index is 0.39% with standard deviation 5.09%.

- For the least (most) financialized commodities, average gross monthly excess return is 0.65% (0.15%), with standard deviation 8.03% (5.27%).

- Extending the momentum ranking interval to three months and 12 months progressively increases strategy returns and reduces the advantage of non-financialized over financialized commodities.

- For the base term structure strategy (1-2 term spread) over the entire sample period:

- Average gross monthly return in excess of that for a broad commodities index is 0.92% with standard deviation 4.00%.

- For the least (most) financialized commodities, average gross monthly excess return is 1.43% (0.41%), with standard deviation 7.12% (4.98%).

- Widening the term structure spread to contracts 1-3 and 1-4 reduces the advantage of non-financialized over financialized commodities.

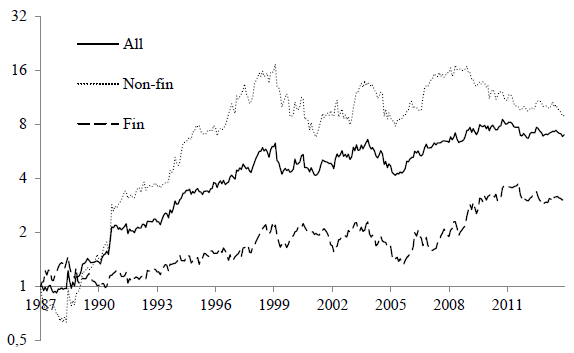

The following chart, taken from the paper, tracks on a logarithmic scale gross cumulative values of $1 investments at the beginning of 1987 in three versions of the base (1-month ranking interval) momentum strategy:

- All: an equally weighted, fully collateralized portfolio of all commodities as available.

- Non-fin: a similar portfolio of the half of commodities that are least financialized.

- Fin: a similar portfolio of the half of commodities that are most financialized.

Terminal value for portfolio 2 (3) at the end of 2013 is $9.00 ($2.12), indicating that financialization weakens the momentum strategy.

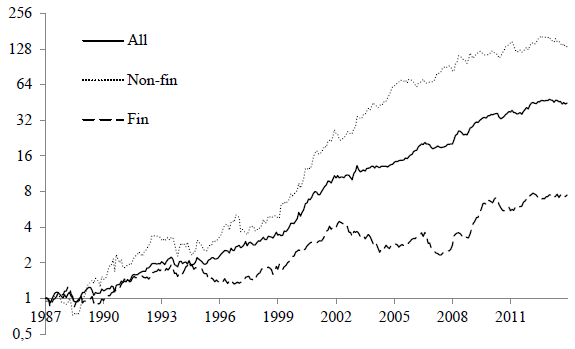

The next chart, also from the paper, tracks on a logarithmic scale gross cumulative values of $1 investments at the beginning of 1987 in three versions of the base (1-2 term spread) term structure strategy:

- All: an equally weighted, fully collateralized portfolio of all commodities as available.

- Non-fin: a similar portfolio of the half of commodities that are least financialized.

- Fin: a similar portfolio of the half of commodities that are most financialized.

Terminal value for portfolio 2 (3) at the end of 2013 is $134 ($6.47), indicating that financialization weakens the term structure strategy.

In summary, evidence indicates that financialization has weakened commonly used commodities investing strategies.

Cautions regarding findings include:

- Reported returns are gross, not net. Including trading frictions would reduce these returns.

- As noted, volatilities of strategies focused on the least financialized commodities tend to be relatively volatile.

- As noted in the study, sample sizes are very small for some commodity futures series.