Subscribers have asked whether substituting Market Vectors Gold Miners ETF (GDX) for SPDR Gold Shares (GLD) as a proxy for gold improves the performance of the Simple Asset Class ETF Momentum Strategy (SACEMS)? To check, we backtest the strategy twice using either GLD or GDX to represent gold, and then compare results. Using dividend-adjusted closing prices for SACEMS asset class proxies and the yield for Cash during June 2006 (per tracked SACEMS) through September 2020, we find that:

As in the baseline version of SACEMS, we each month rank all assets based on 4-month past returns. Because GDX is not available until May 2006, we use GLD to determine whether GDX is a winner at the beginning of the sample period until September 2006.

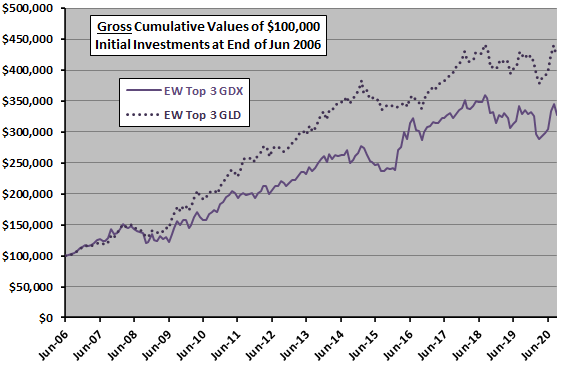

The following chart compares gross cumulative values of $100,000 initial investments in the SACEMS equally weighted (EW) Top 3 portfolio with GDX or with GLD. The GDX alternative underperforms substantially. Results from “GDX and GDXJ vs. GLD” suggest that the high volatility of GDX compared to GLD drive the underperformance.

For perspective, we compare monthly and annual performance statistics for the two alternatives across three SACEMS portfolios.

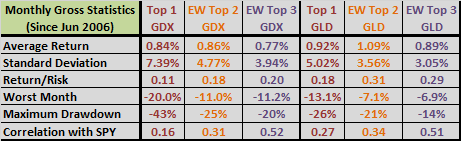

The following table summarizes monthly statistics for SACEMS Top 1, EW Top 2 and EW Top 3 portfolios with GDX or GLD over the full sample period. Return/Risk is average return divided by standard deviation. Maximum drawdowns are based on monthly measurements over the sample period. Confirming above results, SACEMS with GLD generally beats SACEMS with GDX.

The next table summarizes annualized/annual statistics for SACEMS Top 1, EW Top 2 and EW Top 3 portfolios with GDX or GLD over the full sample period. Annualized returns are compound annual growth rates (CAGR). For Sharpe ratio, to calculate excess annual return, we use average monthly yield on 3-month Treasury bills during a year as the risk-free rate for that year. Again, SACEMS with GLD generally beats SACEMS with GDX.

In summary, evidence does not support belief that GDX is a better choice than GLD as a proxy for gold in SACEMS.

Cautions regarding findings include:

- Cautions for SACEMS apply.

- Testing alternative proxies for an asset class introduces data snooping bias, thereby overstating performances of best and worst alternatives.