What steps should investors consider to mitigate impact of inevitable large U.S. stock market corrections? In their May 2019 paper entitled “The Best of Strategies for the Worst of Times: Can Portfolios be Crisis Proofed?”, Campbell Harvey, Edward Hoyle, Sandy Rattray, Matthew Sargaison, Dan Taylor and Otto Van Hemert compare performances of an array of defensive strategies with focus on the eight worst drawdowns (deeper than -15%) and three NBER recessions during 1985 through 2018, including:

- Rolling near S&P 500 Index put options, measured via the CBOE S&P 500 PutWrite Index.

- Credit protection portfolio that is each day long (short) beta-adjusted returns of duration-matched U.S. Treasury futures (BofAML US Corp Master Total Return Index), scaled retrospectively to 10% full-sample volatility.

- 10-year U.S. Treasury notes (T-notes).

- Gold futures.

- Multi-class time-series (intrinsic or absolute) momentum portfolios applied to 50 futures contract series and reformed monthly, with:

- Momentum measured for 1-month, 3-month and 12-month lookback intervals.

- Risk adjustment by dividing momentum score by the standard deviation of security returns.

- Risk allocations of 25% to currencies, 25% to equity indexes, 25% to bonds and 8.3% to each of agricultural products, energies and metals. Within each group, markets have equal risk allocations.

- Overall scaling retrospectively to 10% full-sample volatility.

- With or without long equity positions.

- Beta-neutral factor portfolios that are each day long (short) stocks of the highest (lowest) quality large-capitalization and mid-capitalization U.S. firms, based on profitability, growth, balance sheet safety and/or payout ratios.

They further test crash protection of varying allocations to the S&P 500 Index and a daily reformed hedge consisting of equal weights to: (1) a 3-month time series momentum component with no long equity positions and 0.7% annual trading frictions; and, (2) a quality factor component with 1.5% annual trading frictions. For this test, they scale retrospectively to 15% full-sample volatility. Throughout the paper, they assume cost of leverage is the risk-free rate. Using daily returns for the S&P 500 Index and inputs for the specified defensive strategies during 1985 through 2018, they find that:

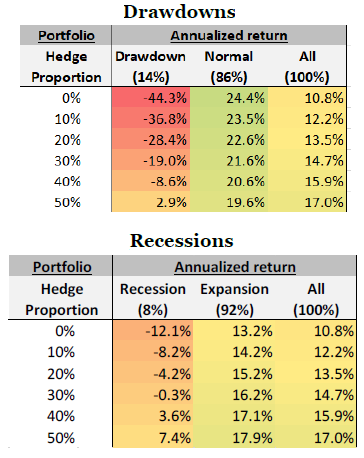

- 14% (86%) of sample days occur during S&P 500 Index worst drawdowns as specified (other conditions), with associated index annualized return -44.3% (24.4%).

- 8% (92%) of sample days fall during recessions (expansions), with associated S&P 500 Index annualized return -12.1% (13.2%).

- S&P 500 Index put options perform well during all eight drawdowns, but not very well during recessions. Over the full sample, annualized excess return is -7.4% for the index put options. An equal-weighted combination of the S&P 500 index and index put options has negative excess returns for all eight drawdowns and overall. Accounting for steep options trading frictions would worsen returns.

- The credit protection portfolio performs similarly to put options during drawdowns and recessions, with negative average returns during other conditions. Over the full sample, average return is modestly negative. Estimated trading frictions for this portfolio via synthetic indexes are less than 0.1% per year.

- T-notes perform well during post-2000 equity drawdowns, but not during previous ones (the post-2000 negative bond-equity correlation is historically atypical). T-note annualized excess return during drawdowns (other conditions) is 10.6% (3.1%). T-note performance is consistently positive during recessions.

- Gold futures have positive returns for all but one drawdown, with annualized excess return 9.0%. However, average return during other times is negative, such that overall performance is about flat. Average excess return is positive for two of three recessions. Estimated trading frictions for gold futures are less than 0.1% per year.

- Time series momentum portfolios perform well overall during drawdowns and recessions, but the 12-month lookback with long equity positions allowed has negative excess returns during the last three drawdowns and is relatively weak during recessions. The version excluding long equity positions does better during drawdowns but mostly worse overall. Estimated trading frictions for a 3-month lookback are in the range 0.6%-0.8% per year.

- The composite quality factor portfolio and profitability, payout and safety portfolios individually perform well during drawdowns, and over the full sample. Growth individually performs poorly during both drawdowns and other times. During recessions, some profitability and payout factors perform relatively well. Estimated trading frictions are in the range 1.0%-2.0% per year.

- The time-series momentum portfolio and the quality factor portfolio have uncorrelated returns, such that they work well in combination (see the tables below).

The following tables, extracted from the paper, summarize net annualized excess returns for varying daily rebalanced allocations to:

- The S&P 500 Index.

- A hedge portfolio consisting of equal positions in time series momentum based on 3-month lookback with no long equity positions and a quality factor, rebalanced daily and scaled retrospectively to 15% annual volatility.

For example, a hedge proportion of 30% implies a 70% allocation to the S&P 500 Index. and a 30% allocation to the hedge portfolio, rebalanced daily. The upper table decomposes performances during the eight worst S&P 500 Index drawdowns and other (normal) times during 1985 through 2018. The lower table decomposes performances during the three U.S. economic recessions and other times (expansions) during the same period.

Results indicate that larger hedge allocations around 50% work better than smaller ones.

In summary, evidence indicates that a combination of a multi-class futures time series momentum portfolio and a quality factor portfolio may attractively protect against U.S. stock market crashes.

Cautions regarding findings include:

- Many investors may not be able to achieve the low portfolio maintenance costs that are based on experience of the authors.

- The best defensive strategies (multi-class futures momentum and quality hedges) are beyond the reach of most investors, who would bear fees for delegating to an investment manager/fund.

- Retroactive scaling to target volatility impounds look-ahead bias. Scaling defensive positions based on volatility predictions may affect findings.

- The assumption that leverage is available at the risk-free rate may not hold for some investors.

- Testing multiple defensive strategies (including different time series momentum lookback intervals and different quality factor components) using the same equity market sample introduces data snooping bias, such that the best-performing strategies overstate expectations. Combining these best strategies compounds bias, and testing multiple allocations to defensive strategies introduces additional snooping bias.

See also the following related items: