Is there an objective way to benchmark the performance of trend-following Managed Futures hedge funds? In their March 2016 paper entitled “Adaptive Time Series Momentum – Benchmark for Trend-Following Funds”, Peter Erdos and Gert Elaut test a futures timing system that increases (decreases) allocations when trends are emerging (fading) per 251 equally weighted, volatility-scaled, daily rebalanced time series momentum (TSMOM) strategies. Strategy lookback intervals range from 10 to 260 trading days. Volatility scaling involves dividing momentum returns by an exponentially weighted daily moving average estimator of volatility over a 60-day rolling window. They account for trading frictions (bid-ask spread plus broker/market fees by asset class, estimated separately for old and new subperiods), exchange rates, one-day signal-to-trade execution delay and estimated management/performance fees. They apply the TSMOM system as a mechanical benchmark for trend-following Managed Futures hedge funds. They examine also a momentum “speed factor” that buys longer-term and sells shorter-term TSMOM strategies. Using daily prices for 98 futures contract series and monthly net-of-fee returns for 379 live and dead trend-following Managed Futures hedge funds during January 1994 through September 2015, they find that:

- Over the sample period, the TSMOM system has:

- On a gross basis, average annual return 10.2%, annualized Sharpe ratio 1.02 and maximum drawdown -14.0%.

- On a net basis, average annual return 6.2%, annualized Sharpe ratio 0.62 and maximum drawdown -23.4%.

- Combining the TSMOM system with a speed factor strategy in 80%-20% proportions boosts net annual return to 7.0% and net annualized Sharpe ratio to 0.70, and slightly suppresses net maximum drawdown -21.8% (but makes return skewness less positive).

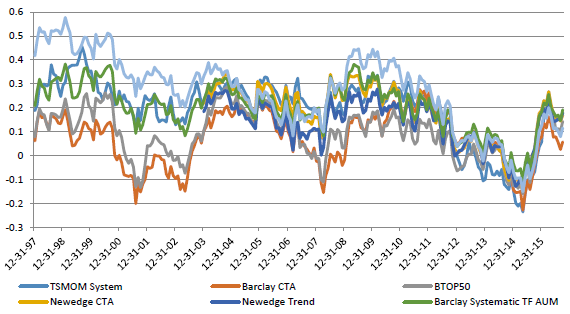

- The TSMOM system alone explains a substantial part of the return behavior of trend-following Managed Futures funds (see the chart below).

- Some Managed Futures funds exhibit positive alpha with respect to the TSMOM system that tends to persist from year to year. This alpha:

- Relates positively to speed factor exposure, suggesting that skillful fund managers exploit the speed factor.

- Tends to be higher (lower) for funds with higher equity (fixed income) momentum exposure.

- Relates negatively to fund size, but positively to fund age.

- Has no relationship with magnitude of fund management/performance fees.

- Investors in Managed Futures funds exhibit strong return-chasing, focusing almost solely on return last year.

The following chart, taken from the paper, compares rolling 3-year Sharpe ratios for the TSMOM system and five indexes of Managed Futures hedge funds (which have varying levels of focus on trend following funds). In general, the TSMOM system Sharpe ratio tracks those of the fund indexes closely (but is often higher), suggesting that it is a useful and aggressive benchmark for performance of trend-following Managed Futures hedge funds.

In summary, evidence suggests that the TSMOM system represents an aggressive benchmark for trend-following Managed Futures hedge funds.

Cautions regarding findings include:

- TSMOM benchmarking system calculations are complicated.

- TSMOM system volatility-scaling calculations include several potential optimizations (moving average decay parameter, rolling estimation window length and a “correction” factor), thereby risking snooping bias in construction.

- The 80%-20% weights for the combined TSMOM system/speed factor are experimentally optimal and impound snooping bias.