A subscriber requested evaluation of Jay’s Pure Momentum Sector Fund System, specified by originator Jay Kaeppel as follows:

- At the end of the first month, assign 20% weight to the five of the 40 Fidelity Select Sector funds (excluding Select Gold, FSAGX) with the largest positive returns over the previous 240 trading days.

- At the end of each subsequent month, sell any positions that drop out of the top five and reallocate proceeds equally to their replacements.

- If for any month fewer than five funds have positive returns, leave unpopulated positions in cash.

This system involves both relative momentum (picking past winners) and absolute or intrinsic momentum (requiring positive past returns). The author states that the publication year for the system is 2001, so we start with 2002 for a test free of data snooping. We accept annual returns for 2002 through (partial) 2015 as reported by the author . We consider two simple benchmarks: (1) buy and hold SPDR S&P 500 (SPY); and, (2) hold SPY when it is above its 10-month simple moving average and 3-month U.S. Treasury bills (T-bills, a proxy for cash) otherwise (SPY-SMA10). The second benchmark is a simple, widely used market timing rule that helps decide whether Jay’s Pure Momentum Sector Fund System outperforms the market because of sector rotation (relative momentum) or market timing (absolute momentum). Using annual returns for Jay’s Pure Momentum System, monthly dividend-adjusted prices and annual returns for SPY and monthly T-bill yields during 2002 through mid-September 2015 (nearly 14 years), we find that:

Assumptions for the SPY-SMA10 benchmark are:

- An investor can accurately anticipate the SMA10 signal just before each monthly close, and thereby act accordingly at the same close.

- For each switch between SPY and cash, debit a switching friction of 0.1%.

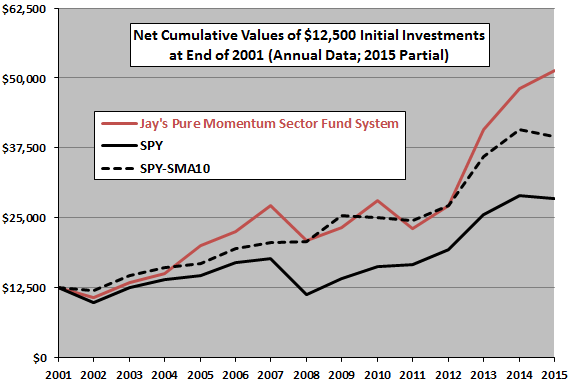

The following chart compares net cumulative performances of Jay’s Pure Momentum Sector Fund System, SPY and SPY-SMA10 using annual data over the sample period. The starting value of $12,500 derives from five times the $2,500 minimum investment for the Fidelity funds. Respective net performance statistics for Jay’s Pure Momentum Sector Fund System, SPY and SPY-SMA10 are:

- Compound annual growth rate (CAGR): 10.8%, 6.1% and 8.7%.

- Arithmetic average annual return: 12.3%, 8.2% and 9.7%.

- Standard deviation of annual returns: 19.7%, 20.1% and 11.6%.

- Annual Sharpe ratio (using average monthly T-bill yield during a year as the annual risk-free rate for that year): 0.56, 0.32 and 0.67.

Comparing trajectories suggests that some of the outperformance of Jay’s Pure Momentum Sector Fund System relative to SPY comes from sector rotation (relative momentum) and some comes from market timing (shifting to and from cash based on absolute momentum).

The sample is short for assessing annual performance. Also, mutual funds may have loads, minimum investment requirements and (as in this case) early redemption fees. Early redemption fees may affect returns for monthly portfolio reformation as specified for Jay’s Pure Momentum Sector Fund System. Loads, and early redemption rules/fees may change over time. The minimum investment requirement may interfere with the system after drawdowns (as in 2002), such that it is not possible to fund five positions in some months.

The performance of SPY-SMA10 is not very sensitive to assumed level of switching friction because there are only 14 switches.

How does the performance of Jay’s Pure Momentum Sector Fund System compare with the conceptually similar “Simple Sector ETF Momentum Strategy” with market timing rule overlay?

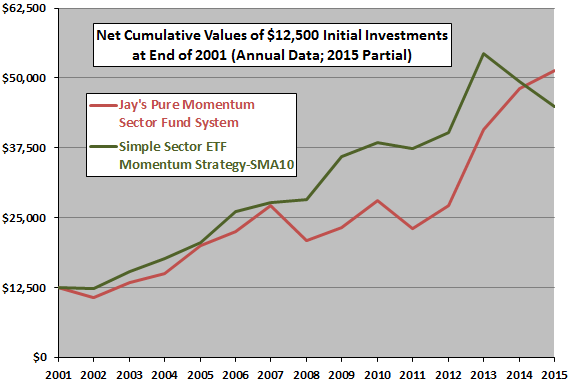

The next chart compares net cumulative performance of Jay’s Pure Momentum Sector Fund System to that of the Simple Sector ETF Momentum Strategy with an S&P 500 Index SMA10 overlay. Differences between the two strategies are:

- The former considers 40 Fidelity sector mutual funds, while the latter considers only nine SPDR sector exchange-traded funds (ETF).

- The former looks for the top five funds based on past 240-day returns, while the latter looks only for the top fund based on past six-month returns.

- The former shifts partly (fully) to cash when only one to four (zero) winner funds have positive past returns, while the latter shifts completely to cash when the S&P 500 Index is below its SMA10.

- The former incurs no switching frictions (ignoring any early redemption fees), while the latter incurs a switching friction of 0.1% for each change in holdings ($12.50 based on initial funding).

- The former is completely out-of-sample, while the latter is partly backtested and partly out-of-sample.

Based on terminal values, net CAGRs for Jay’s Pure Momentum Sector Fund System and the Simple Sector ETF Momentum Strategy with SMA10 overlay are 10.8% and 9.7%, respectively. Net arithmetic average annual returns are 12.3% and 10.4%, respectively, with standard deviations 19.7% and 14.3% and net annual Sharpe ratios 0.56 and 0.64.

“Simple Sector ETF Momentum Strategy Robustness/Sensitivity Tests” indicates that the latter strategy is not very robust to the length of the ranking interval, but that a six-month ranking interval produces about the same outcome as a 240-day (11-month or 12-month) ranking interval.

In summary, evidence from simple tests on limited out-of-sample data suggests that Jay’s Pure Momentum Sector Fund System outperforms the broad U.S. stock market due partly to sector rotation and partly to market timing, but that it does not outperform simpler strategies based on Sharpe ratio.

Cautions regarding findings include:

- As noted, the sample period is short for evaluation of annual performance, especially in terms of number of bear markets to be avoided via market timing.

- As noted, Fidelity mutual fund minimum investment requirements and early redemption fees may interfere with precise implementation of Jay’s Pure Momentum Sector Fund System. These and other potentially interfering rules may have changed during the sample period.

- As noted, the Simple Sector ETF Momentum Strategy is partly in-sample with a near-optimal ranking interval. In other words, it impounds some data snooping bias, tending to overstate out-of-sample expectations.

- There may be some bias in the results for Jay’s Pure Momentum Sector Fund System because the author may choose to write about it after times of outperformance.