Are stock due diligence reports posted on Reddit’s Wallstreetbets (WSB) informative? If so, do users exploit them skillfully? In their March 2021 paper entitled “Place Your Bets? The Market Consequences of Investment Advice on Reddit’s Wallstreetbets”, Daniel Bradley, Jan Hanousek Jr., Russell Jame and Zicheng Xiao examine the value and retail trading impact of single-stock due diligence reports posted on WSB. WSB now has about 9.5 million subscribers and on January 28th, 2021 generated over 271 million pageviews (trailing only Google and YouTube). The authors consider both market-adjusted returns and style-adjusted returns (DGTW-adjusted, compared to stocks matched on size, book-to-market and momentum) of due diligence report stock recommendations. Using 2,340 time-stamped due diligence reports focused on a single common stock (612 distinct stocks) and associated firm accounting data and stock price/trading data during 2018 through 2020, they find that:

- Stock coverage in due diligence reports tilts towards unprofitable, volatile stocks with low institutional ownership. 81% (19%) convey buy (sell) recommendations.

- For the 1,878 reports with buy recommendations:

- Average market-adjusted cumulative gross return from time of posting to close of the same trading day is 0.91%, growing to 1.20% over the next day, 1.76% over the next week and 3.92% over the next month.

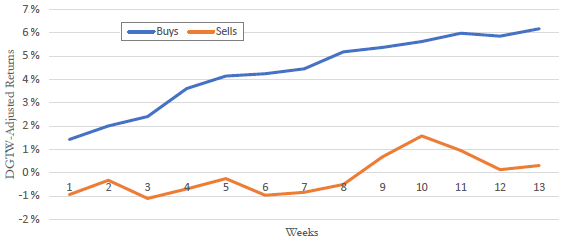

- Average DGTW-adjusted cumulative gross return is slightly lower than market-adjusted gross return, with respective holding interval returns of 0.86%, 1.12%, 1.45% and 3.92%. After 13 weeks, average DGTW-adjusted cumulative gross return is 6.17%, exhibiting no intermediate-term reversal.

- Abnormal gross returns for 454 reports with sell recommendations hover close to zero across holding intervals (see the chart below).

- Usefulness of buy recommendations persists after excluding those associated with other information events (including earnings announcements, sell-side analyst research, unusual media coverage and a previous due diligence report). In fact, average abnormal returns for the residual 472 buy recommendations are larger (though less reliable) than those of other buy recommendations.

- Retail trading increases sharply (by an average 7%) during the five half-hours after report posting. This increase concentrates among stocks with higher returns (suggesting traders discern report quality).

The following chart, taken from the paper, tracks average cumulative DGTW-adjusted gross returns for 13 weeks after posting of WSB due diligence reports with buy or sell recommendations. Average cumulative gross return for buy recommendations grows steadily over the 13 weeks, while that for sell recommendations hovers near zero. In other words, reports with buy (sell) recommendations may be (are not) useful for trading.

In summary, evidence indicates that WSB due diligence reports with buy recommendations may be useful for short-term trading, and that users of these reports can discriminate between strong and weak reports.

Cautions regarding findings include:

- Reported returns are gross, not net. Accounting for trading frictions would reduce all returns. Bid-ask spreads may be exceptionally high for WSB due diligence report recommendations, generating high trading frictions.

- Event-level returns may not translate to portfolio-level performance due to clustering of recommendations (forcing high cash levels within the portfolio while awaiting opportunities).

- Shorting fees/constraints may inhibit effects and exploitation of sell recommendations.