Are Morningstar’s Ultimate Stock-Pickers good stock pickers? In his June 2014 paper entitled “Using Random Portfolios to Evaluate the Performance of the Ultimate Stock-Pickers Index”, Stefaan Pauwels compares the quarterly volatility-adjusted performances of the Morningstar Ultimate Stock-Pickers (USP) top buys, top holdings and top sells to those of many randomly generated (zero-skill) portfolios. Morningstar specifies USP members as fund managers across a range of equity styles with: (1) tenure longer than average within style category; and, (2) 1-year, 3-year, 5-year and 10-year returns exceeding that of the broad equity market. Each quarter, Morningstar generates lists of top ten USP buys, holdings and sells. The study compares the volatility-adjusted returns of these equally weighted lists to those of 1,000 equally weighted portfolios of ten stocks randomly selected each quarter from the S&P 500 Index. He performs volatility adjustment by dividing quarterly return by the standard deviation of daily returns during the quarter. Using quarterly USP lists from the end of November 2010 through early September 2013 and contemporaneous quarterly total returns and daily returns for associated stocks and the stocks in the S&P 500 Index, he finds that:

- The USP top ten holdings do not change much over time, encompassing only 18 unique stocks over the entire sample period.

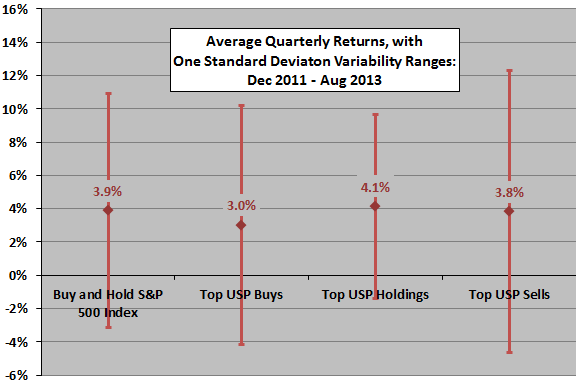

- Over the sample period, USP top holdings outperform the S&P 500 Total Return Index, but top buys underperform the index (see the chart below).

- On a volatility-adjusted quarterly basis over the sample period, random portfolios outperform:

- Top USP buys 60% of the time, suggesting some poor timing.

- Top USP holdings 40% of the time, suggesting some stock-picking skill.

- Top USP sells 56% of the time, suggesting a little timing skill.

The following chart, constructed from data in the paper, compares the average quarterly returns for the S&P 500 Total Return Index and the equally weighted top USP buys, top holdings and top sells, reformed quarterly, over the entire sample period, with one standard deviation variability ranges. Respective cumulative returns are 48.6%, 35.2%, 54.4% and 45.9%. Results suggest that the top USP holdings may be worth tracking, but the top USP buys are unattractive and the top USP sells are not amenable to shorting. In other words, the Ultimate Stock-Pickers may be able to identify good stocks but they exhibit poor timing in acquiring them.

In summary, evidence offers a little support for belief that the Ultimate Stock-Pickers are good stock pickers, but not that they time their transactions well.

Cautions regarding findings include:

- The sample period is short, encompassing less than a dozen independent quarterly return measurements and little variety in economic and stock market environments. Results generally do not meet conventional thresholds for statistical significance.

- Reported results are gross, not net, to the progressive disadvantage of increasingly passive investments. For example, an S&P 500 Index fund is more passive than top USP holdings which is in turn more passive than top USP buys and random portfolios.

- The paper is less than clear on some points, and the author has not responded to questions.