Do equity style mutual funds look more attractive when benchmarked to matched style stock indexes than to more theoretical factor models of stock returns? In their April 2015 paper entitled “On Luck versus Skill When Performance Benchmarks are Style-Consistent”, Andrew Mason, Sam Agyei-Ampomah, Andrew Clare and Steve Thomas compare alphas for U.S. equity style mutual funds as calculated with conventional factor models and as calculated with matched Russell style indexes. The factor models they consider are the 1-factor capital asset pricing model (CAPM), the Fama-French 3-factor model (market, size, book-to-market) and the Carhart 4-factor model (adding momentum). They consider both value (net asset value)-weighted and equal-weighted portfolios of mutual funds. They also perform simulations to control for differences in the precision of alpha estimates due to differences in fund sample sizes. Using monthly gross and net returns and equity styles for 2,384 surviving and dead U.S. diversified equity funds, and returns for Russell equity style indexes and market/size/value/momentum factors, during January 1990 through December 2011, they find that:

- For all funds grouped on either a value-weighted or an equal-weighted basis, CAPM monthly net alphas are slightly positive, and 3-factor and 4-factor monthly net alphas are slightly negative. In other words (as found in prior studies), on average, no significant level of skill is evident.

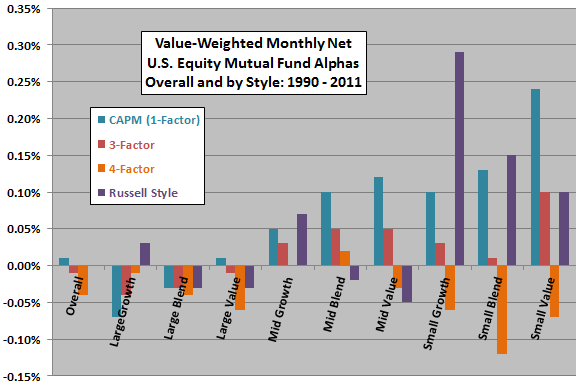

- Monthly net alphas vary across style groupings and across calculation methods within styles (see the chart below). Overall, results suggest that:

- Investors are more likely to encounter skill among mid-cap and small-cap funds.

- Among small-cap funds, the appearance of skill depends substantially on whether calculations include the momentum factor. In other words, momentum appears to be an important driver of small-cap fund performance.

- After accounting for fund style, conventional factors add little incremental power to explain variation in fund returns.

- Based on Russell index style benchmarks about 5% (5%) of sampled mutual funds convincingly exhibit superior (inferior) skill. The level of skill generally increases from large-cap to mid-cap to small-cap funds.

The following chart, constructed from data in the paper, summarizes four sets of monthly net alphas for mutual fund style groups weighted by asset value over the entire sample period. The four sets of alphas derive from regressions of style group returns versus:

- CAPM returns.

- Fama-French 3-factor returns.

- Carhart 4-factor returns.

- Matched Russell style index returns.

Results indicate that:

- Alphas vary widely across both fund styles and across methods of calculation.

- Broad stock market (CAPM) outperformance and Russell index benchmark outperformance concentrate in small-cap funds.

- Momentum strategies are important contributors to these two views of outperformance.

Findings based on equal weighting of funds are qualitatively similar.

In summary, evidence arguably supports belief that style indexes are as meaningful as factor models for evaluating the skillfulness of mutual fund managers, both in aggregate and fund by fund. Style index benchmarks suggest that mutual fund alpha concentrates in small-cap funds.

Cautions regarding findings include:

- Russell index benchmarks are theoretically investable but not actually invested. There would be costs to maintaining tracking funds to account for stocks that disappear via merger/bankruptcy, appear as newly listed companies and migrate across style boundaries. These costs would slightly lower benchmark returns and therefore boost mutual fund alphas calculated using them, and perhaps vary by style.

- Focus on average monthly return and alpha obscures risk metrics such as volatility and drawdown.