Do short-term trade ideas of professional stock analysts have merit? In their July 2019 paper entitled “Are Analyst Trade Ideas Valuable?”, Justin Birru, Sinan Gokkaya, Xi Liu and René Stulz examine the price impact of analyst trade ideas, which differ from stock ratings in that trade ideas:

- Have horizons of only one week to three months.

- Reflect expected short-term price changes in response to upcoming news (firm catalysts) or short-term overreaction/underreaction to recent news (temporary mispricing).

- May be opposite in direction from the analyst’s rating on a stock.

- Are typically issued on days with no firm news and no other analyst reports.

They estimate abnormal returns of trade ideas based on an equally weighted portfolios of stocks with similar size, book-to-market ratio and momentum characteristics. For trade idea buy and sell portfolios, they add a new stock at the close on the trading day after idea announcement and rebalance the portfolio on any day a stock is added or removed. Using a manually constructed sample of 4,167 buy ideas and 367 sell ideas from 688 analysts at 77 brokers involving 1,619 unique stocks during 2000 through 2015, they find that:

- Firm catalysts (temporary mispricing) uniquely motivate 70% (21%) of trade ideas. The remaining 9% involve both.

- 98% of trade ideas expire within one week to three months.

- About 30% of trade ideas go against the analyst’s recommendation on the stock, and 18% involve stocks for which there is no active recommendation.

- Trade ideas generally involve large, liquid stocks with relatively high institutional ownership, low book-to-market ratios and low idiosyncratic volatilities.

- Trade idea buys (sells) have average gross abnormal return 1.11% (-2.38%) through the day after announcement. Excluding firms with concurrent news and analyst reports reduces return to 0.91% (-1.96%).

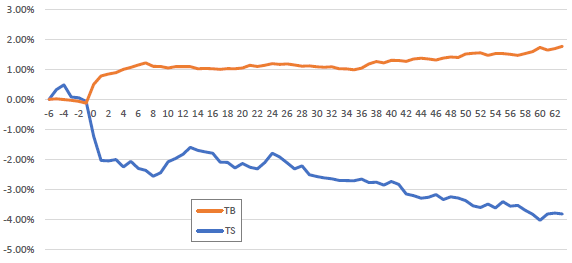

- During the three months after announcement, average trade idea gross abnormal returns exhibit slow continuation of initial direction without reversal (see the chart below). After three months, average gross cumulative return for buys (sells) is about 0.90% (-1.5%) higher (lower) than initial 2-day average gross abnormal return.

- Trade ideas have about the same effect as analyst recommendation revisions and three times effects of target price and earnings forecast revisions.

- Effects are larger for trade ideas:

- Motivated by firm catalysts.

- Opposite the direction of concurrent stock recommendations.

- From larger brokers and All Star Analysts.

- From analysts exhibiting greater past skill at identifying trade ideas.

- From analysts who produce trading research (and thereby usually have more general and industry-specific experience).

- On average, institutional trading in the direction of trade ideas spikes on announcement dates. Commission-paying institutional clients of brokers issuing trade ideas significantly increase trading on associated stocks as early as three days before announcement.

The following chart, taken from the paper, compares average gross cumulative abnormal returns for trade idea buys (TB) and sells (TS) from six trading days before through 63 trading days after announcement, excluding those announced concurrently with firm-specific news or fundamental research. Results show that: (1) the initial reaction is pronounced; (2) effects are persistent; and, (3) effects are stronger for sells than buys.

In summary, evidence indicates that trade ideas issued by broker analysts likely have value, especially for institutional clients of the issuing broker.

Cautions regarding findings include:

- As noted in the paper, reported returns are gross, not net. Accounting for trading frictions from position entries and exits and from daily portfolio rebalancing would reduce these returns.

- Timely maintenance of a portfolio of short-term trade ideas from broker analysts is beyond the reach of most investors, who would bear fees for delegating such work to an investment/fund manager.