Does hedge fund outperformance derive from systematically superior timing or from superior asset selection? In the December 2010 version of her paper entitled “Can Factor Timing Explain Hedge Fund Alpha?”, Hyuna Park decomposes alpha generated by hedge funds into security selection and timing with respect to eight risk factors (including U.S. and emerging equity risk premiums). Her essential measure of factor timing performance is degree of fund success in raising (lowering) exposure to a factor when the factor’s return is high (low). For example, a fund with a high equity market beta when stock returns are high and low equity market beta when stock returns are low demonstrates good timing of the equity risk premium. She gives special attention to relatively illiquid hedge funds to ensure that frequent trading does not obscure factor timing ability and considers both aggregate and individual fund performances. Using net returns and other characteristics for 6,114 live and dead hedge funds during 1994-2008, she finds that:

- Hedge fund multi-factor alpha is significantly positive over the entire sample period.

- Security selection on average explains most of the alpha generated by hedge funds. The contributions to alpha from timing the overall equity market and other factors are trivial. Specifically:

- For illiquid-style hedge funds in aggregate, factor timing reduced alpha generated by security selection. Of the 0.42% monthly alpha generated by an equally weighted portfolio of illiquid-style hedge funds during 1994-2008, more than 100% derives from security selection (0.52% per month) and the contributions of factor timing and equity risk premium are negative (-0.07% and -0.04% per month, respectively).

- For liquid-style hedge funds in aggregate, factor timing contributes only marginally to overall alpha. Of the 0.64% monthly alpha generated by the equally weighted portfolio of liquid-style hedge funds during 1994-2008, 0.50% derives from security selection, 0.11% from factor timing and 0.03% from the market equity risk premium.

- Results are similar at the fund level. For individual hedge funds, the average monthly alphas attributable to security selection, factor timing and the equity risk premium are 0.47%, 0.05% and 0.05%, respectively.

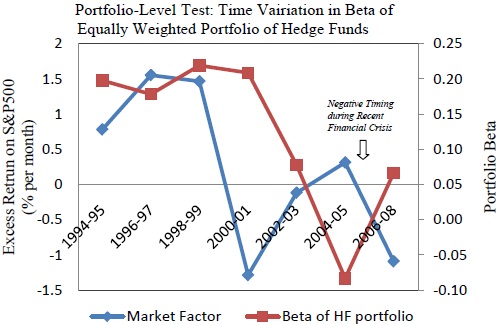

- During the financial crisis of 2007-08, while the excess return on S&P 500 Index dropped sharply, hedge funds on average increased exposure to the U.S. equity market (see the chart below).

- A robustness test using 12 HFRX indexes generally confirms that hedge funds do not successfully time the equity and credit markets during 2003-2010.

The following chart, taken from the paper, summarizes the aggregate ability of hedge funds to time the U.S. equity market by comparing market return to hedge fund exposure to U.S. equities. Results indicate that hedge funds do not systematically anticipate good or bad market returns. Specifically, during the financial crisis of 2007-08, the excess return on S&P500 index dropped sharply while hedge funds in aggregate increased their exposures to U.S. equities.

In summary, evidence indicates that hedge funds generate alpha by identifying mispriced securities, not by timing the equity risk premium or other systemic risk factors. In other words, the investing talent concentrated in the hedge fund industry by incentive fees enables superior security selection but not superior market timing.

Individual investors may therefore want to focus their research efforts on: (1) security selection rather than market timing; or, (2) fund managers and advisors who claim success based on security selection rather than market timing.