Would retail investors improve portfolio performance by using robo-advisors to manage holdings they have selected? In their July 2019 paper entitled “Artificial Intelligence Alter Egos:Who benefits from Robo-investing?”, Catherine D’Hondt, Rudy De Winne, Eric Ghysels and Steve Raymond compare performances of portfolios held by each of a large sample of actual individual investors to that of a robo-investor constrained to the stocks and exchange-traded funds (ETF) held by that investor over a rolling 2-year historical window. They consider three robo-investor strategies:

- Mean-variance optimization with guiding average and variance estimates based straightforwardly on 2-year rolling historical windows and parameters set to maximize Sharpe ratio.

- Mean-variance optimization guided by machine learning algorithms and sophisticated covariance estimators, with two variations in variance estimation.

- Equal weight.

Robo-investors may hold cash, but they may not sell short, with focus on quarterly portfolio rebalancing. They measure portfolio performance monthly and exclude trading frictions. Using common stock/exchange-traded fund (ETF) trading records for 20,622 individual Belgian brokerage accounts during January 2003 through March 2012, they find that:

- Sample investors earn average (median) monthly gross return 0.42% (0.13%), with standard deviation 10.04%. 86% of assets held are non-Belgian, and roughly a quarter are U.S. Median trading frequency is twice per month.

- Based on median gross performance and quarterly rebalancing of robo-investor portfolios of stocks and ETFs (see the chart below):

- Straightforward mean-variance optimization outperforms actual investors by 0.58% per year and greatly suppresses maximum drawdown.

- Machine learning-augmented mean-variance optimization outperforms actual investors by 3.0%-3.4% per year and suppresses maximum drawdown. The two variations perform very similarly.

- Equal weight underperforms actual investors by 0.54% per year and only modestly suppresses maximum drawdown.

- During the 2008-2009 financial crisis, the median robo-investor moves to cash.

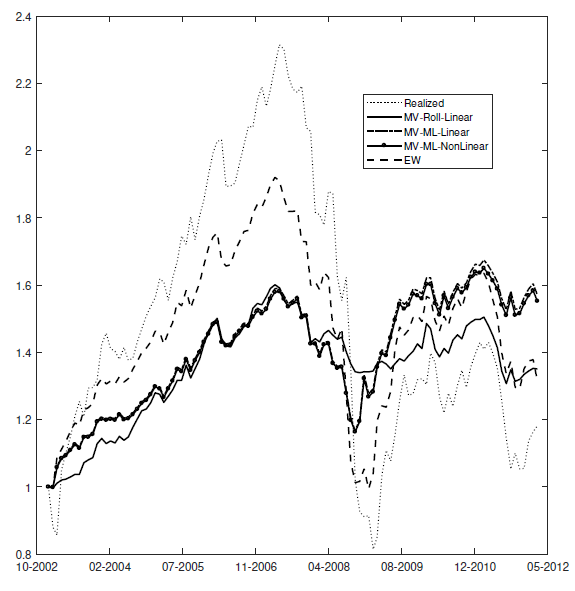

The following chart, taken from the paper, compares gross cumulative median values of one unit initial investment in each of the following over the full sample period:

- Realized – actual investors.

- MV-Roll-Linear – robo-investor strategy 1 above.

- MV-ML-Linear and MV-ML-Nonlinear – the two variations of robo-investor strategy 2 above.

- EW – robo-investor strategy 3 above.

Medians are by month, so they do not represent the same investor or robo-investor through time. Over the full sample period, MV-ML-Linear has the highest cumulative return of 60%, compared to 20% for Realized. Notable points are:

- The presence of a severe crash in the sample may be critical to robo-investor outperformance.

- Machine learning usefully augments mean-variance optimization.

In summary, evidence suggests that sophisticated robo-advisors may help retail investors largely by suppressing portfolio drawdowns.

Cautions regarding findings include:

- Reported performance data are gross, not net. Trading frictions would reduce returns for all portfolios. The authors assert that: “Since robo-investors trade less than the average/median investor, namely only once a quarter in the lead example, this should yield conservative estimates of the robo-investing gains.” However, robo-investor turnovers may still be higher than those of actual investors due to number of assets rebalanced/traded.

- Sophisticated robo-investing may not be free. Any fee paid to the offeror would reduce robo-investor portfolio returns.

- Testing multiple robo-investor strategies on the same sample introduces data snooping bias, such the the best-performing strategy overstates expectations. Moreover, since the strategies come from prior research involving the same sample period, they may inherit snooping bias from original sources.

- Investors may not be able to identify outperforming robo-advisors ex ante.