How are the asset allocations of the largest university endowments, conventionally accepted as among the best investors, evolving? In their December 2016 paper entitled “The Evolution of Asset Classes: Lessons from University Endowments”, John Mulvey and Margaret Holen summarize recent public reports from large U.S. university endowments, focusing on asset category definitions and allocations. Using public disclosures of 50 large university endowments for 2015, they find that:

- Approaches to categorization of asset classes are diverse. The typical breakdown is: public equity (with geographic subcategories), private equity, real assets (real estate and natural resources), absolute return (hedge funds) and fixed income.

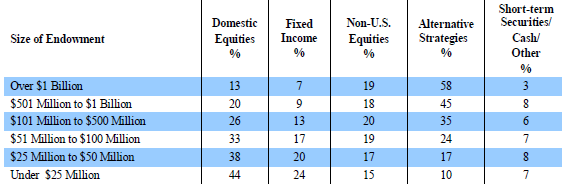

- There is a broad shift to alternative investments, from 23% in 2000 to 51% in 2014, and 57% for endowments over $1 billion (see the table below for a 2016 update).

- Common top-down requirements are growth, inflation protection, manager quality, exploitation of less efficient markets and balance between liquid and illiquid investments.

- There is some movement toward defining asset categories by target performance or underlying return drivers rather than traditional classes.

The following chart, taken from the 2016 Study of Endowment Reports, summarizes university endowment asset allocations as of June 30 2016. Alternative strategies include: private equity; hedge funds of various types; venture capital; non-campus real estate; natural resources (oil, gas, timber, commodities and managed futures); and, distressed debt. Results show that allocations to traditional asset classes (alternative strategies) tend to decrease (increase) with fund size.

In summary, recent reports of university endowments indicate continuation of a shift away from traditional asset classes and toward alternative strategies.

Cautions regarding findings include

- The paper does not address endowment/asset class performance.

- As noted in the paper, source material is self-reported and therefore varying in conventions and depth.

- Many of the alternative strategies employed by university endowments are impractical for most investors.

See also: