Who are the givers and who are the takers among mutual funds and hedge funds? In their January 2016 paper entitled “Style and Skill: Hedge Funds, Mutual Funds, and Momentum”, Mark Grinblatt, Gergana Jostova, Lubomir Petrasek and Alexander Philipov analyze quarter-to-quarter changes in Form 13F stock holdings to assess investment styles and sources of performance for hedge funds and mutual funds. They focus on the interaction between portfolio weight changes and future stock returns to measure investing skill. They calculate fund alpha via adjustments for stock size, book-to-market ratio and (when appropriate) momentum. Using quarterly 13F filings of 589 mutual funds and 1,342 hedge funds during 1998 to 2012, they find that:

- Most hedge funds (about two thirds) are contrarian, buying stocks with low past returns. 80% of hedge funds that are contrarian during the first half of the sample period remain contrarian during the second half.

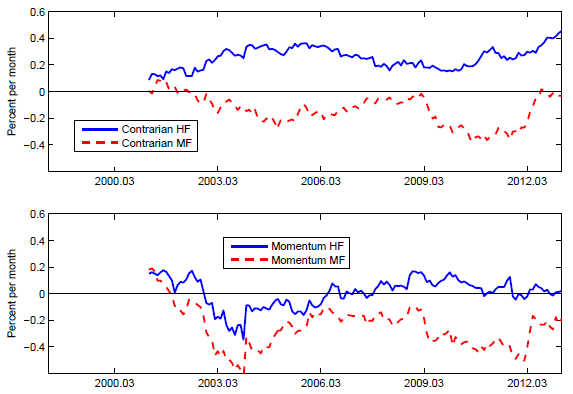

- Contrarian hedge funds generate 2.4% average gross annual alpha, outperforming contrarian mutual funds, momentum mutual funds and momentum hedge funds (see the charts below).

- Outperformance of contrarian hedge funds derives mostly from stock picking (selecting the right losers). The net purchases of these funds generate 2.2% average gross annual alpha, outperforming net sales (excluding short sales) by 3.2% average gross annual alpha.

- Performance persistence exists among contrarian hedge funds, but not among any other group of funds/institutional investors.

- Most mutual funds (about two thirds) follow momentum both for purchases and sales. 76% of mutual funds that follow momentum during the first half of the sample period continue to follow momentum during the second half.

- Momentum mutual funds outperform contrarian mutual funds.

- After controlling for momentum, mutual funds exhibit no stock picking skill.

- The most profitable trades of contrarian hedge funds are purchases of stocks sold by momentum mutual funds, which are perhaps forced sales to maintain investor liquidity.

The following charts, taken from the paper, track 36-month moving averages of monthly alphas of portfolio changes (equally weighted buys minus sells) for contrarian hedge funds and mutual funds (upper chart) and momentum hedge funds and mutual funds (lower chart). Results indicate that only the trades of contrarian hedge fund advisors consistently produce a positive alpha over the sample period. Trades of momentum hedge funds are roughly neutral. Trades of mutual funds mostly generate negative alpha.

In summary, evidence indicates that contrarian hedge funds outperform momentum hedge funds and both contrarian and momentum mutual funds, mostly due to superior stock picking.

Cautions regarding findings include:

- Results are gross and idealized (equally weighted), not net. In other words, results may not match the experiences of fund investors due to impacts of trading frictions, fixed fees, incentive fees, high-water marks and actual portfolio weights.

- Many investors do not have access to hedge funds.

- Mutual funds generally offer investors greater liquidity than hedge funds, and that liquidity involves a cost.

- Following the trades of contrarian hedge funds via 13F filings would involve a lag that may work against exploitation.