Are mutual fund managers whose holdings deviate most from their benchmarks the best performers? In their April 2015 paper entitled “Deactivating Active Share”, Andrea Frazzini, Jacques Friedman and Lukasz Pomorski investigate whether Active Share is a reliable indicator of future mutual fund performance. Active Share measures the distance between a portfolio and its benchmark, ranging from zero for a portfolio that is identical to its benchmark to one for a portfolio with no holdings in common with its benchmark. They consider both theoretical arguments and empirical analysis, with the latter focused on disentangling Active Share and benchmark effects. Using holdings and performance data for actively managed U.S. equity mutual funds during 1980 through 2009, they find that:

- Theoretically:

- Identification of counterparties who consistently lose to managers with high Active Shares is lacking (it cannot be the benchmarkers).

- Managers with low active shares can outperform. For example, a fund benchmarked to the S&P 500 Index can outperform the index by 4.5% per year with an active share of only 2.2% by avoiding the worst five stocks in the index.

- Other research looking at several measures of active management other than Active Share find no evidence of performance predictability.

- Empirically:

- Based on benchmark-adjusted returns, the fifth of fund managers with the highest Active Shares generate an average 2% higher annual four-factor alpha (adjusting for market, size, value and momentum factors) than the fifth with the lowest Active Shares.

- However, most funds with high (low) Active Shares have small-capitalization (large-capitalization) index benchmarks. A sort on Active Share is therefore equivalent to a sort on benchmark.

- Based on raw fund returns instead of benchmark-adjusted returns, there is no statistical difference between performance of funds with high and low Active Shares.

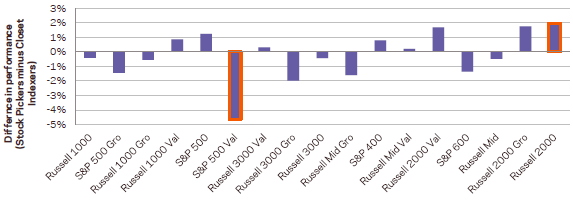

- For subsamples formed by benchmark, Active Share does not reliably predict fund returns or alphas (see the chart below).

The following chart, taken from the paper, summarizes annualized differences in average four-factor alphas between the fifths of active U.S. equity mutual funds with the highest and lowest Active Shares sorted by benchmark (in order of lowest to highest average Active Share from left to right). The most active funds outperform the least active funds for eight of 17 benchmarks. The least active funds outperform for the other nine benchmarks. Red borders highlight statistical significance.

In summary, neither theory nor empirical evidence support belief that the Active Share of a fund relates reliably to its future performance.

Cautions regarding findings include:

- There is perhaps some indication that Active Share is meaningful for small-capitalization styles (those benchmarking Russell 2000 indexes in the chart above).

- However, testing Active Share across a large group of subsamples introduces snooping bias, such that the best and worst performing subsamples tend to overstate results.

- Adding the latest five years of data seems worthwhile (lengthening the sample period by 17%).

See also the related “Measuring the Level and Persistence of Active Fund Management” and “Focus on the Most Intensely Active Mutual Funds?”.