Do SeekingAlpha and StockTwits offer valuable stock-picking information? In their March 2015 paper entitled “Crowds on Wall Street: Extracting Value from Collaborative Investing Platforms”, Gang Wang, Tianyi Wang, Bolun Wang, Divya Sambasivan, Zengbin Zhang, Haitao Zheng and Ben Zhao evaluate the stock-picking expertise available via SeekingAlpha and StockTwits. They tailor stock sentiment measures for these sources and relate these measures to future stock and stock market performance. They test ranking of author informativeness both directly via future stock returns and indirectly by level of reader interaction (comments). They then test strategies for exploiting sentiments of top authors. Finally, they summarize responses to a May 2014 survey of 500 SeekingAlpha authors (95 responses) and 500 non-contributing SeekingAlpha users (104 responses). Using SeekingAlpha content from launch in 2004 through March 2014, StockTwits content from launch in 2009 through February 2014 and daily returns (not including dividends) from associated individual stocks and S&P 500 SPDR (SPY) as a market proxy, they find that:

- The most active 20% of SeekingAlpha (StockTwits) authors contributed 80% of articles (90% of messages).

- Over 70% (90%) of SeekingAlpha articles (StockTwits messages) focus on the 10% most covered stocks.

- Across all SeekingAlpha articles and all StockTwits messages, stock sentiments offer little information about future stock returns. In other words, average predictive power is close to zero.

- Evidence is mixed regarding the most informative (top) authors (see the chart below):

- A subset of SeekingAlpha authors with the highest comment levels over the past year expresses sentiments that significantly outperform SPY on a gross basis. A portfolio that initially allocates equal funds to S&P 500 stocks and then each week sells any stock with negative past-week sentiment from these top authors and holds (or buys back if sold before) other stocks generates gross normalized (equally weighted) cumulative capital gain 108% over eight years, compared to 47.5% for SPY. A long-short strategy based on the same sentiments modestly boosts cumulative gain but also significantly increases volatility.

- However, the same strategy for top StockTwits authors generates gross normalized cumulative capital gain 54.5% over four years, compared to 64.1% for SPY.

- The same strategy with daily portfolio reformation somewhat depresses (boosts) top author gross performance for SeekingAlpha (StockTwits).

- Based on future portfolio performance, total past-year comment level is the best way to identify top authors.

- From the survey of SeekingAlpha authors and non-author users:

- 70% of users state that they sometimes or very often trade stocks based on sentiments expressed in articles.

- 83% of users state that they trust some or most authors.

- 62% of authors believe their articles impact stock prices.

- 80% of both authors and users state that they have seen manipulative articles on SeekingAlpha.

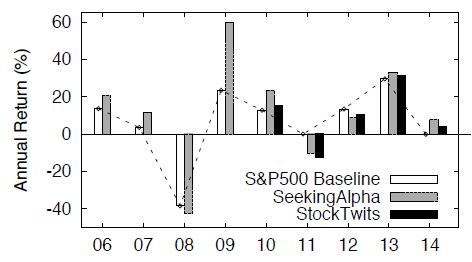

The following chart, taken from the paper, summarizes gross normalized annual capital gains for the top author SeekingAlpha and StockTwits weekly strategies described above, along with the capital gain for the S&P 500 (SPY) over available sample periods. Results indicate that:

- Most of the gross outperformance associated with top SeekingAlpha authors occurs during 2009. A possible interpretation is that outperformance derives from high-beta preferences during a strong market rally. This group underperforms SPY during three of eight years.

- Top StockTwits authors outperform SPY on a gross basis during three of five years, but not by much.

Trading frictions for weekly portfolio adjustments would likely be material. Excluding dividends tends to favor active strategies (which may miss dividends) over buy-and-hold (which does not miss dividends).

In summary, evidence for reliable net exploitability of the informativeness of top authors on SeekingAlpha and, especially, StockTwits is not convincing.

Cautions regarding findings include:

- As noted, performance of portfolios based on top author sentiments is gross, not net. Including trading frictions and (when applicable) shorting costs for weekly portfolio reformation would reduce returns and may alter findings. Also, as noted, accounting for dividends may affect findings.

- Sentiment measurement methods are sufficiently elaborate, with manual interventions, that they would be difficult to replicate.

- Even for the simplest author ranking metric (total comments over the past year), tracking is problematic.

- The methodology incorporates snooping bias from selecting empirically and featuring the best way to rank authors based on subsequent portfolio performance. Results therefore likely overstate expectations.

- The 30-stock and 500-stock portfolio simulators associated with the study confirm (through mid-August 2015) that: (1) the outperformance of top author sentiment concentrates during 2009; and, (2) during many other intervals, top author sentiment underperforms.