In the June 2018 draft of their paper entitled “An Information Factor: Can Informed Traders Make Abnormal Profits?”, Matthew Ma, Xiumin Martin, Matthew Ringgenberg and Guofu Zhou construct and test a long-short information factor (INFO) based on observed trading of firm insiders, short sellers and option traders. Specifically, the INFO portfolio:

- Is each month long the 10% (decile) of stocks with the highest levels of net buying (purchases minus sales) by top managers scaled by the average number of shares held by all top managers over the calendar year.

- Is each month short stocks based on both short interest (number of shares short divided by shares outstanding) and associated option trading activity (volume of liquid put and call options divided by volume of associated stock). They sort stocks independently on short interest and option trading activity, add the two ranks for each stock and short the decile of stocks with the highest combined ranks.

They further examine whether INFO is a key driver of hedge fund returns. Using monthly data for specified variables, monthly returns for a broad sample of U.S. stocks priced over $5 and monthly returns for 13 hedge fund indexes and 5,565 individual U.S. equity hedge funds during February 1996 (limited by options data) through December 2015, they find that:

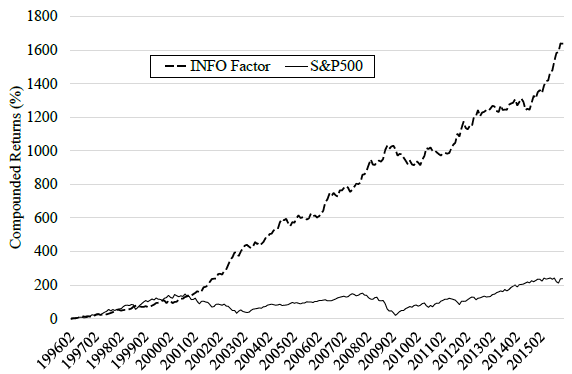

- INFO portfolio average monthly gross return is 1.24%, with standard deviation 2.65% and monthly gross Sharpe ratio 0.39 (see the chart below). Monthly gross alpha is in the range 1.16% to 1.22%, depending on the factor model used (three to five factors).

- INFO outperforms other widely used factors over the sample period.

- Average gross monthly returns for the market, size, book-to-market and momentum factors are 0.57%, 0.24%, 0.18% and 0.47%, respectively.

- INFO monthly gross Sharpe ratio is four (five) times that of the market (momentum) factor.

- Momentum factor monthly gross alpha is in the range 0.06% to 0.75%, depending on the factor model used.

- INFO explains a substantial portion of equity hedge fund returns.

- A one standard deviation increase in INFO relates to a 0.65% increase in aggregate value of hedge funds.

- Funds in the top decile of information skill (measured as covariation between fund returns and INFO returns) outperform those in the bottom decile by an average 0.45% per month.

The following chart, taken from the paper, compares cumulative returns of the INFO portfolio and the S&P 500 Index over the full sample period. Terminal gains are 1639% and 238%, respectively. The INFO factor does not outperform the broad market during the first five years of the sample period.

In summary, evidence indicates that a long-short strategy that follows arguably informed insider trading, short selling and options trading may be attractive.

Cautions regarding findings include:

- As noted, reported performance is gross, not net. Accounting for trading frictions driven by monthly portfolio reformation would reduce returns.

- Implementing a strategy based on INFO is beyond the reach of most investors, who would bear fees for delegating to a fund manager.

- The sample, ending December 2015, is somewhat stale. Using only a 20-year sample exacerbates the staleness.

- The overall approach may impound data snooping bias from prior research in selecting proxies for informed trading.