Can investors exploit information about hedge fund stock holdings in SEC Form 13F filings? In their October 2019 paper entitled “Systematic 13F Hedge Fund Alpha”, Mobeen Iqbal, Farouk Jivraj and Luca Angelini investigate whether carefully culled “best ideas” of equity hedge funds produce significantly beat the S&P 500 Total Return (TR) Index. Using quarterly Form 13Fs for U.S. equity long-short, equity market neutral, equity long-only and equity event-driven hedge funds, they measure: individual hedge fund manager conviction regarding a stock based on size of position; and, hedge fund manager consensus regarding a stock based on the number of funds holding it. Using proprietary data, they identify hedge funds exhibiting long-term investment approaches. They then 47 days after the end of each quarter (to ensure availability of Form 13Fs), reform a portfolio from among long-term hedge funds holding at least five stocks, as follows:

- Exploit conviction by identifying all stocks comprising at least 7.5% of a fund portfolio.

- Exploit consensus by buying the equal-weighted top 50 of these stocks in terms of number of hedge managers holding them.

Using processed quarterly data from hedge fund Form 13Fs, the specified proprietary data on hedge fund investment approaches and returns for associated stocks during the first quarter of 2004 through the second quarter of 2019, they find that:

- During the May 2004 through June 2019 test period, the S&P 500 TR Index has average annual return 10.3% and annual volatility 18.3%, with annual Sharpe ratio 0.56 and maximum drawdown (MaxDD) 55%.

- Across all U.S. equity hedge funds during May 2004 through June 2019, the quarterly reformed and equally weighted top fifth (quintile) of:

- Conviction stocks generates average gross annual return 13.2% and annual volatility 20.3%, with gross annual Sharpe ratio 0.65 and MaxDD 58%.

- Consensus stocks generates average gross annual return 13.0% and annual volatility 20.0%, with gross annual Sharpe ratio 0.65 and MaxDD 55%.

- The combined conviction-consensus strategy applied only to long-term hedge fund investors, as specified above (see the chart below):

- Generates average gross annual return 14.1% and annual volatility 18.9%, with gross annual Sharpe ratio 0.75 and MaxDD 54%.

- Has 6-factor (market, size, book-to-market, profitability, investment, momentum) gross monthly alpha 0.32%.

- In contrast, the combined conviction-consensus strategy applied only to short-term hedge fund investors performs similarly to the S&P 500 Total Return Index and has zero 6-factor alpha.

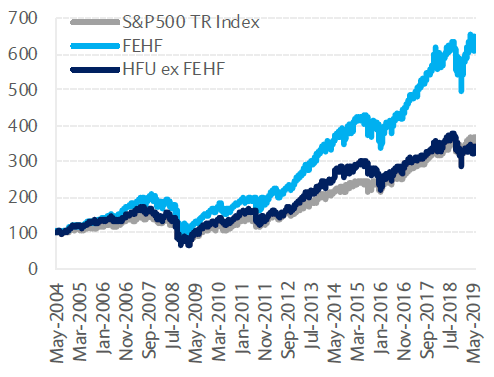

The following chart, taken from the paper, compares cumulative gross values of $100 initial investments over the test period in the S&P 500 TR Index, combined conviction-consensus strategy applied only to long-term hedge fund investors (FEHF) and the combined conviction-consensus strategy applied only to short-term hedge fund investors (HFU ex FEHF). Results show that FEHF easily beats and HFU ex FEHF approximately matches the S&P 500 TR Index.

In summary, evidence indicates that high-conviction, broad-consensus holdings of those U.S. equity hedge fund managers with relatively long investment horizons may outperform the broad U.S. stock market (but not avoid deep drawdowns).

Cautions regarding findings include:

- Performance data are gross, not net. Accounting for quarterly portfolio reformation frictions and ongoing costs of processing Form 13Fs and obtaining required proprietary data would reduce active strategy returns. Use of equal weighting for active strategies may exacerbate frictions via substantial positions in relatively illiquid stocks.

- MaxDDs are unattractively deep for all active strategies.

- An equity hedge fund index may be a more appropriate benchmark than the S&P 500 TR Index.

- There may be data snooping bias inherited from cited research and added via specifications for the combined conviction-consensus strategy (7.5% hedge fund weight threshold, top 50 stocks cutoff and method of deciding which hedge fund managers are long-term investors).

- The approach described is beyond the reach of most investors, who would bear fees for delegating to fund managers.

See also “Exploiting Consensus Mutual Fund Conviction Stock Picks”.