Are Chief Financial Officers (CFO) better informed than Chief Executive Officers (CEO) when it comes to trading the stocks of their companies? In their March 2011 paper entitled “Are CFOs’ Trades More Informative than CEOs’ Trades?”, Weimin Wang, Yong-Chul Shin and Bill Francis investigate whether open market trades made by CFOs are better predictors of associated stock returns than trades made by CEOs. They examine insider purchases and sales separately instead of using net sales and focus on purchases to avoid non-informative liquidity sales. They calculate abnormal returns relative to 100 benchmark portfolios matched by market capitalization (size) and book-to-market ratio. Using data for 12,936 CEO and 7,049 CFO purchases and 24,527 CEO and 13,909 CFO sales of shares in their companies during January 1992 through July 2002, along with subsequent daily stock returns, benchmark portfolio returns and risk factor data, they find that:

- Sales dominate purchases in dollar terms, reflecting the ongoing need of top executives to dispose of compensation-related options and restricted shares.

- Combined CEO and CFO stock purchases anticipate an average 12-month gross abnormal return of 4.17%, concentrated in the first three months after transactions, on a debiased equal-weighted basis.

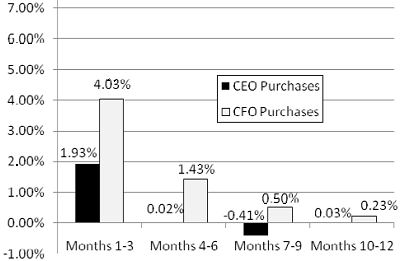

- CFO purchases beat CEO purchases by an average 5.00%, with outperformance concentrated in the first three months and largely complete by nine months. Specifically, CFO purchases on average outperform CEO purchases by 2.58% in months 1-3, 1.17% in months 4-6 and 1.02% in months 7-9 after transaction.

- Outperformance of CFO purchases thus holds well after public disclosure. Average gross abnormal returns during the 12 months after disclosure are 6.19% for CFO purchases and 1.57% for CEO purchases, a difference of 4.62%. Most of the outperformance (4.42%) occurs during the first nine months (see the chart below). The relatively small magnitude of the average gross return during the three trading days after CFO filings (0.23%) suggests that the market is slow to incorporate private CFO information after disclosure.

- Outperformance of CFO purchases concentrates in small and midsize firms. It is absent in the top quarter of market capitalizations.

- Persistence of CFO outperformance after adjusting for market, three-factor (plus size and book-to-market) and four-factor (plus momentum) risks indicates that CFOs beat CEOs for some reason other than riskier trading.

- CFO purchases are better predictors of future earnings surprises than CEO purchases, suggesting that CFOs have better information about future earnings of their firms.

- Combined CEO and CFO stock sales anticipate an average 12-month gross abnormal return of -2.55%, with -3.14% (-2.22%) separately attributable to CFOs (CEOs), confirming that that insider sales are less informative than insider purchases. After adjusting for market, three-factor and four-factor risks, neither CEOs nor CFOs earn gross abnormal returns after sales.

The following chart, taken from the paper, shows average gross abnormal returns for four consecutive three-month intervals after CEO and CFO open market stock purchases over the entire sample period. The first interval starts the second trading day after disclosure filing date. Results indicate that:

- Insider purchases are informative.

- CFO purchases are more informative than CEO purchases for all return intervals.

- The market is especially slow to incorporate the information conveyed by CFO purchases.

In summary, evidence indicates that investors may be able to get an edge by mimicking the open market stock purchases of CFO insiders at small and midsize companies.

Note that since the end of the sample period used in the study (July 2002), the lag between an insider trade and public disclosure of the trade shrinks from 10-40 days to two days.

Cautions regarding study findings include:

- Reported returns are gross, not net. Including trading frictions incurred in mimicking CFO trades would dent these returns.

- Since signals from CFO purchases are irregular (and may cluster over time), it may be infeasible to maintain 100% capital allocation to a diversified portfolio determined by CFO purchases. In other words, a strategy mimicking CFO purchases may have large allocations to cash some of the time, limiting portfolio return.

- Increased regulatory scrutiny since the sample period may have reduced informativeness of CEO and CFO open market trades.