Do equity analyst stock recommendations have the same post-publication predictive value worldwide? In the September 2013 version of their paper entitled “Where are the World’s Best Analysts?”, Campbell Harvey, Sam Radnor, Khalil Mohammed and William Ferreira assess the ability of equity analysts by global region (Asia ex-Japan, Japan, Europe ex-UK, the UK and the U.S.) to forecast returns of the stocks they cover by measuring average cumulative returns after buy and sell recommendations. They adjust all returns based on regional stock indexes. Using analyst forecasts during 2005 (after regulations regarding analyst research change) through 2012, they find that:

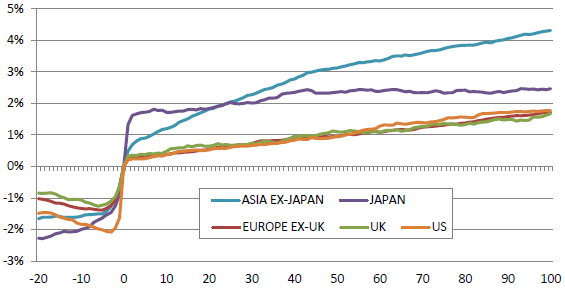

- For buy recommendations on average (see the first chart below):

- Gross returns are materially positive in all regions, strongest initially in Japan and strongest eventually in Asia ex-Japan.

- Higher trading frictions do not offset the superior gross performance in Asia ex-Japan.

- Superior gross performance in Asia ex-Japan is persistent across subperiods.

- The ratio of buy to sell recommendations ranges from 2:1 for Asia and Europe to 3:1 for the U.S.

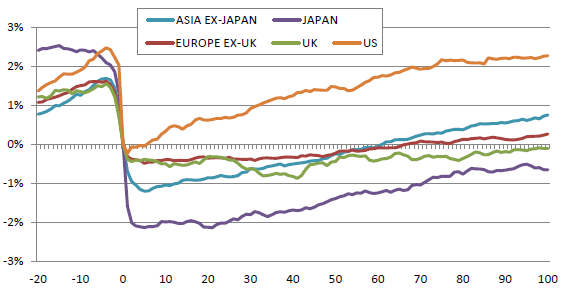

- For sell recommendations on average (see the second chart below):

- Gross returns are generally negative for a few days after publication, most strongly in Japan and hardly at all in the U.S.

- Prices then generally revert, most strongly in the U.S, even outperforming the market in most regions.

The following chart, taken from the paper, shows average gross market-adjusted performance of BUY recommendations from 20 trading days before (-20) to 100 trading days after (100) recommendation by region during 2005 through 2012. Day 0 corresponds to 0% and represents the close on the first day following publication, such that all subsequent gross returns are exploitable. Buy recommendations tend to outperform the market in all regions during the months after publication, most strongly in Asia ex-Japan.

The next chart, also from the paper, shows average gross market-adjusted performance of SELL recommendations from 20 trading days before (-20) to 100 trading days after (100) recommendation by region during 2005 through 2012. Again, day 0 corresponds to 0% and represents the close on the first day following the announcement, such that all subsequent gross returns are exploitable. There is short-term downward pressure in most regions (not the U.S.) immediately after publication, after which stocks drift upward, most strongly in the U.S.

In summary, evidence from post-publication stock returns after buy and sell recommendations suggests that equity analysts have some ability to predict (or influence) stock returns, more so in Asia than other regions and more so for buys than sells.

Cautions regarding findings include:

- The study does not address variability (risk) in post-publication performance of recommendations.

- The study does not address portfolio-level returns achievable via exploitation of average post-publication returns.