Are financial advisors expert guides for their client investors? In their December 2017 paper entitled “The Misguided Beliefs of Financial Advisors”, Juhani Linnainmaa, Brian Melzer and Alessandro Previtero compare investing practices/results of Canadian financial advisors to those of their clients, including trading patterns, fees and returns. They estimate account alphas via multi-factor models. Using detailed data from two large Canadian mutual fund dealers (accounting for about 5% of their sector) for 3,276 Canadian financial advisors and their 488,263 clients, and returns and fees for 3,023 associated mutual funds, during January 1999 through December 2013, they find that:

- The average advisor (client) invests almost exclusively in actively managed mutual funds, with only 1.2% (1.5%) of portfolios allocated to passive funds.

- Most advisors personally underdiversify and trade frequently, just as they advise their clients. Client purchases frequently coincide with those of their advisor purchases, but rarely with those of other advisors. Correlations in trading behavior between advisor and clients ranges from 0.14 to 0.29.

- Based on average fund annual expense ratios, advisors invest in slightly more expensive mutual funds than their clients (2.43% versus 2.36%). Advisors with personal portfolios in the top tenth (decile) of fees recommend client portfolios that are 0.26% more expensive than those recommended by advisors in the bottom decile.

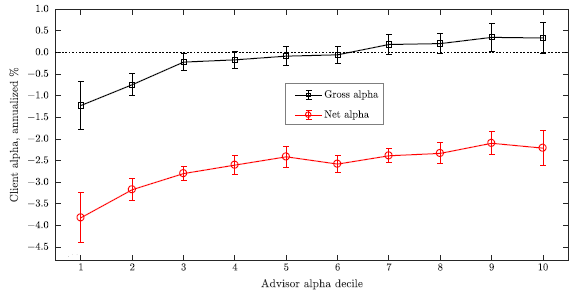

- Average annual gross (net) alphas are 0.14% (-3.07%) for clients and -0.68% (-3.66%) for advisors. Additional fees reduce average annual client alpha by a further -0.15%, while rebates and commissions raise average annual advisor alpha by 0.66%. Clients retaining advisors in the bottom decile of personal alphas have an average 1.6% lower average annual alpha than those retaining top-decile advisors (see the chart below).

- Average idiosyncratic portfolio risk of clients retaining advisors in the top decile of idiosyncratic risk is twice that of clients retaining advisors in the bottom decile.

- Advisor effects on client portfolio performance dominate those explained by client age, income, risk tolerance and financial knowledge. When clients change advisors, their investment behaviors shift to match those of the new advisor.

- Advisors continue to hold expensive portfolios after they leave the industry.

The following chart, taken from the paper, summarizes gross and net average annual client alphas by decile of matched advisor alphas. Net alphas are all substantially negative. Client alphas, both gross and net, mostly increase with advisor alpha, such that gross (net) average annual alpha of clients retaining advisors in the top decile are 1.56% (1.61%) higher than those of clients retaining advisors in the bottom decile.

In summary, evidence from personal investment data offers little or no support for belief that Canadian investment advisors are exemplary investors.

Cautions regarding findings include:

- The sample of Canadian financial advisors may not be representative of all advisors.

- As noted in the paper, regulators seeking to improve financial advisor recommendations would have to specify what constitutes “good advice” (good strategic and tactical investing strategies) thereby may limit investor choices and increase the costs of advice. Perhaps the investing practices/results of regulators would support belief in their wisdom.