How should financial advisers and investors approach retirement income planning? In their January 2021 paper entitled “A Model Approach to Selecting a Personalized Retirement Income Strategy”, Alejandro Murguia and Wade Pfau design and validate a questionnaire designed to quantify retirement income styles based on six preference scales:

- Probability-based vs. Safety First (main) – depending on market growth vs. contractually promised.

- Optionality vs. Commitment (main) – flexibility to respond to changing economic conditions/personal situation vs. fixed commitment.

- Time-based vs. Perpetuity (secondary) – fixed horizon vs. indefinite retirement income.

- Accumulation vs. Distribution (secondary) – portfolio growth vs. predictable income during retirement.

- Front-loading vs. Back-loading (secondary) – higher income distributions during early retirement vs. consistent life-style throughout.

- True vs. Technical Liquidity (secondary) – earmarked reserves/buffers vs. reserves taken from other goals.

The output is the Retirement Income Style Awareness (RISA)™ Profile. They then link profile types to four main retirement income strategies:

- Systematic withdrawals with total return (conventional portfolio) investing.

- Risk wrap with deferred annuities.

- Protected income with immediate annuities.

- Time segmentation or bucketing.

Based on the body of retirement investment research and survey feedback from 1,478 readers of RetirementResearcher.com, they conclude that:

- Survey feedback confirms that the six preference scales capture the way people think about retirement.

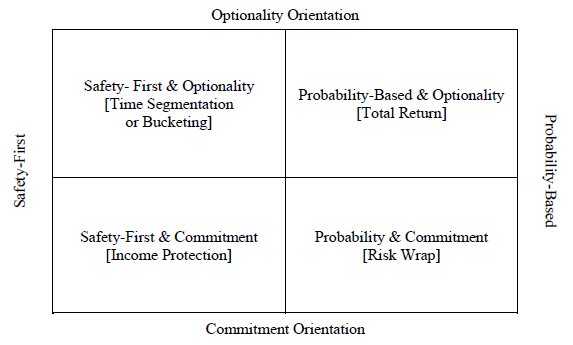

- A matrix with the Probability-based vs. Safety First scale mapped horizontally and the Optionality vs. Commitment scale mapped vertically conveniently identifies four retirement income strategy quadrants (see the figure below). The four secondary preference scales may strengthen matching of retirement income strategies for individuals falling within each quadrant.

- Top right – maintain a conventional diversified investment portfolio rather than implement contracts (annuities) to fund retirement distributions.

- Bottom right – implement deferred annuities offering lifetime income.

- Bottom left – implement deferred annuities with a cash refund or immediate annuities that may not have a death benefit.

- Top left – hold cash buckets for earmarked expected expenses/reserves or maintain a bond ladder, with a diversified portfolio designed to replenish the ladder as components mature.

The following figure, taken from the paper, maps the Probability-based vs. Safety First scale horizontally and the Optionality vs. Commitment scale vertically to identify four retirement income strategy quadrants (styles), characterized principally by risk aversion (high on left and low on right) and desire for flexibility (low on bottom and high on top).

In summary, investors may achieve retirement planning comfort by matching investment strategies to their individual risk aversion/flexibility profiles.

Cautions regarding conclusions include:

- The retirement preferences profile may change over time, in conflict with some prior firm commitments.

- Finding attractive instruments to implement some strategies (such as annuities and bond ladders) may be difficult in a low-interest rate environment. Safety of annuities depends on the financial health of underwriters.

For other research on retirement planning, see results of this search.