Do futures day traders make money? In the March 2011 version of their paper entitled “Overconfident Individual Day Traders: Evidence from a Natural Experiment”, Wei-Yu Kuo and Tse-Chun Lin investigate overconfidence and performance of day traders in the Taiwan futures market. They identify day trades as those committed to close on the same day as a condition of enjoying halved margin deposits. Using complete Taiwan Futures Exchange trading records in Taiwan dollars (TWD) during October 8, 2007 through September 30, 2008 (348,000 trades associated with 3,470 individual day traders who conduct more than 5 day trades), they find that:

- During the sample period, 97% of Taiwan Futures Exchange day-traded contracts are by individuals (domestic institutional investors are ineligible for day trades).

- The mean net profit per trade for individuals is -613 TWD (roughly -$19), and the median is +189 TWD (roughly +$6). The mean (median) net profit per trade for other traders is also negative (positive). Median experience may encourage trading.

- Mean total net profit per individual trader is about -61,500 TWD (roughly -$1,900) over the sample period. The median net profit per individual trader is also negative (-30,000 TWD, or roughly -$940), and less than 20% of individual day traders make a positive net profit.

- The numbers of short and long positions for individuals are similar, but the mean (median) net profits per trade are -196 (+193) TWD for short trades and -1,014 (+148) TWD for long trades.

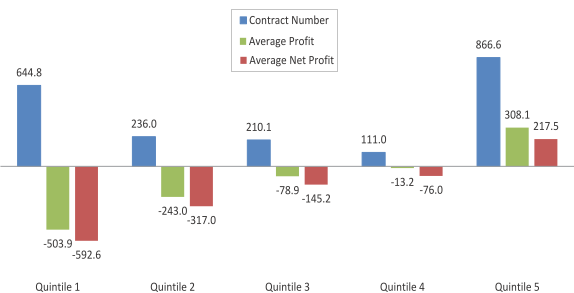

- The relationship between trading frequency and performance is U-shaped (see the chart below). Suggestive of a difference in skill, individual day traders below the 15th (above the 60th) profit percentile perform worse (better) the more they trade.

- Past trading activity, but not past profitability, exhibits a clear positive relationship to subsequent trading activity for individual traders.

The following chart, taken from the paper, summarizes total futures trading activity in number of contracts (Contract Number) by quintile of total gross profit (Total Profit) and total net profit (Total Net Profit) in TWD over the sample period. The U-shaped progression of trading activity implies that the biggest losers and biggest winners both trade a lot. Frequent trading is damaging (beneficial) to losers (winners), suggesting a skill difference. Trading activity sorted by quintile of profit per contract is also U-shaped, but less so.

In summary, evidence from the Taiwan Futures Exchange indicates that only 20% of individual futures day traders make money, but trading frequency by itself is not a clear profitability discriminator (suggesting that skill may be).

Cautions regarding findings include:

- The sample period, which includes the 2008 worldwide crash, may not be representative of longer-term trading experience.

- Futures markets in other countries may differ considerably from the Taiwan Futures Exchange (such as no margin breaks for day trades and greater roles for institutional futures day traders).