Do emerging markets exchange-traded funds (ETF) reliably track and on average achieve the returns of benchmark indexes? In their February 2011 paper entitled “Evaluating the Performance of Global Emerging Markets Equity Exchange-Traded Funds”, David Blitz and Joop Huij examine the performances of emerging markets ETFs comprised of country markets such as South Korea, China, India, Brazil, South Africa and Russia. Stock markets in these countries generally exhibit higher volatilities, lower liquidities and regulatory differences compared to developed markets. Using monthly closing trades, net asset values and expense data for seven ETFs that track broad emerging markets indexes, manage at least $100 million in assets and have live histories of at least one year from inception (ranging from April 2003 to July 2007) through December 2010, they find that:

- The tracking errors of sampled ETFs (standard deviation of monthly mismatch of price and benchmark index), ranging from 3% to 6% annualized, are generally higher than those of ETFs for developed markets.

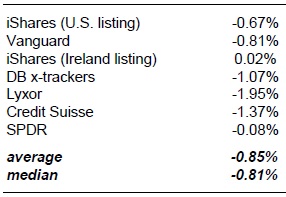

- ETFs for emerging markets on average underperform their total return (dividend-reinvested) benchmark indexes by about 0.85% annually, in line with the average 0.91% annual drag due to fund expenses and dividend taxes. This result indicates that: (1) costs associated with ETF portfolio changes are small; (2) ETF bid-ask spreads cover these costs; and/or, (3) revenues from activities such as securities lending offset these costs.

The following table, extracted from the paper, lists the annualized performances of the seven ETFs sampled relative to respective total return (dividend-reinvested) benchmark indexes. The average shortfall in fund performance is roughly equal to fund expenses and estimated dividend taxes. Data suggest that some funds may be superior to others in matching selected benchmarks.

In summary, evidence from simple tests on limited data suggests that investors may want to consider past performance and tracking error both in selecting emerging markets ETFs and in modeling their diversification of multi-class portfolios.