What lessons do individual investors learn as they gain experience? In their November 2012 paper entitled “Do Stock Traders Learn From Experience? Evidence from an Emerging Market”, John Campbell, Tarun Ramadorai and Benjamin Ranish examine the evolution of performance and trading behaviors with experience among individual investors in Indian stocks. The Indian market has a rapidly growing investor base with direct equity ownership prevalent . Based on data available, they focus on relationships between account age and portfolio changes. Using random samples of monthly data for individual Indian accounts during 2002 through 2011, they find that:

- Individual investors modestly favor small stocks, slightly favor value stocks and strongly avoid momentum stocks.

- Individual accounts slightly underperform the value-weighted Indian stock market by an average (median) 0.05% (0.26%) per month. The bottom (top) 10% of individual investors underperform (outperform) the market by 2.64% (1.23%) per month.

- Among individual investors, stocks sold outperform stocks bought by 3.23% (5.57%) over the next four (12) months.

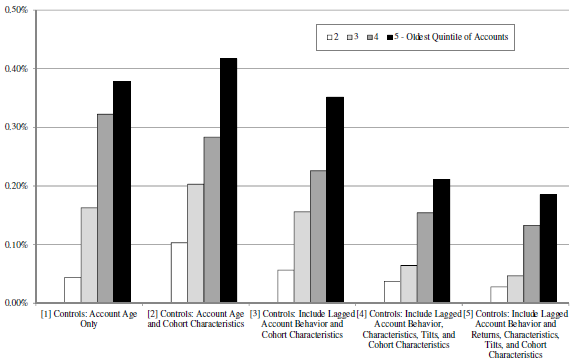

- Older accounts outperform younger ones, in part by overweighting small stocks and exploiting positive momentum (see the chart below). Accordingly, stocks held in older accounts tend to outperform the market.

- Portfolio diversification tends to increase, and turnover and the disposition effect tend to decrease, with account age.

The following chart, taken from the paper, summarizes average monthly return by quintile of account age relative to quintile 1 (new accounts), with various controls, during January 2004 through September 2011. It takes about one, two, three and five years, respectively, for accounts to progress through quintiles 2 through 5. Regardless of controls, relative performance increases systematically with age, with outperformance of quintile 5 ranging from about 0.2% to 0.4% per month. Results from different controls suggest that about half the age effect derives from relative style tilts and half from other aspects of experience.

In summary, evidence indicates that equity individuals continue to improve investment style and trading tactics over at least their first five years of investing.

Cautions regarding findings include:

- Due to lack of data, the study does not relate demographics (such as age, education and occupation) to portfolio performance.

- Some aspects of stock investing may be peculiar to the Indian stock market.