Does technology amplify adverse herding among inexperienced investors? In their October 2020 paper entitled “Attention Induced Trading and Returns: Evidence from Robinhood Users”, Brad Barber, Xing Huang, Terrance Odean and Christopher Schwarz test the relationship between episodes of intense stock buying by retail (Robinhood) investors and future returns. Their source for buying intensity is the stock popularity feature of Robintrack from May 2, 2018 until discontinuation August 13, 2020 (with 11 dates missing and two hours missing for 16 other dates), during which the number of Robinhood user-stock positions grows from about 5 million to over 42 million. They define intense stock buying (herding event) as a dramatic daily increase in number of Robinhood users owning a particular stock in two ways:

- Among stocks with at least 100 owners at the start of the day, select those in the top 0.5% of ratio of owners at the end of the day to owners at the beginning of the day.

- Select stocks with at least 1,000 new owners and at least a 50% increase in owners during the day.

Using Robintrack data supporting these definitions and associated daily stock returns, open and close prices, closing bid-ask spreads and market capitalizations, they find that:

- Based on analysis of outages, Robinhood users account for as much as 6.6% (one third of all retail) trading volume in the 50 most popular Robinhood stocks.

- Definition 1 (2) identifies 4,884 (900) herding events over the sample period.

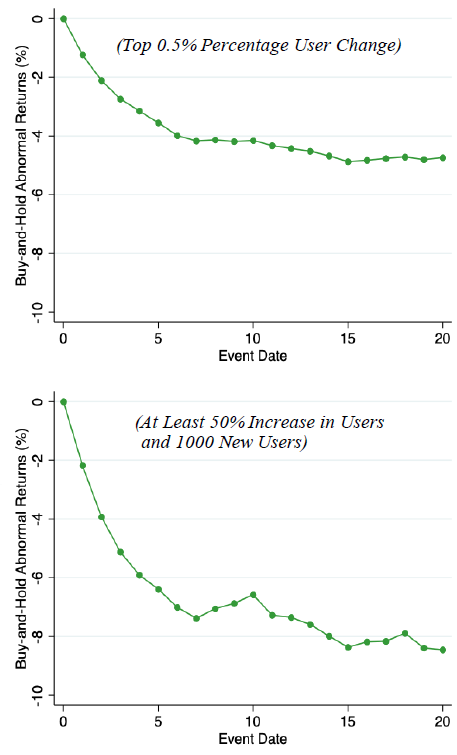

- Average market-adjusted return for herded stocks on herding event day is 14% for definition 1 and 42% for definition 2. However, over the five trading days after herding event day, average market-adjusted return is -3.5% for definition 1 and -6.4% for definition 2 (see the charts below).

- The herding effect concentrates among stocks with relatively low market capitalizations and during the COVID-19 pandemic.

- For definition 1, shorting herded stocks during the five days after herding events generates positive market-adjusted returns 63% of the time. In fact, there is an unusual increase in short selling of these stocks after herding events, consistent with some traders understanding and exploiting Robinhood return reversals.

- The relationship between “Top Movers” and “100 Most Popular” lists on the Robinhood application and future herding events implies persistent amplification of user attention (and action) based on these lists.

The following charts, taken from the paper, track average market-adjusted returns for herded stocks during the 21 trading days (one month) after herding events. The upper (lower) chart uses herding event definition 1 (2) above, showing average return reversals of nearly -5% (-9%) during the month after herding events.

In summary, evidence indicates that return reversals reliably follow intense stock buying by retail investors, especially for small-capitalization stocks, with the effect amplified by simple user interfaces that concentrate attention of inexperienced investors on a few stocks.

Sophisticated investors may be able to anticipate some of the upside associated with herding and some of the downside associated with subsequent reversal.

Cautions regarding findings include:

- Reported average returns are gross, not net. Accounting for round-trip trading frictions and shorting costs/constraints to exploit findings would lower returns. Concentration of the effect among small-capitalization (relatively illiquid) stocks exacerbates this caution.

- Analyses are at the trade level, not a portfolio level. Concentration of herding event opportunities during some intervals implies holding a cash reserve much of the time while awaiting trades, depressing overall return.

- As noted, Robintrack user holdings data are no longer available, interfering with confirmation of effect persistence.

For other research on investor herding, see results of this search.