How effective are tax-deferred savings in avoiding federal income taxes over a lifetime? In their May 2011 paper entitled “The Tax Benefit of Income Smoothing”, Kristian Rydqvist, Steven Schwartz and Joshua Spizman estimate the lifetime benefit of postponing federal income tax liability until retirement by contributing pre-tax dollars to individual or employer-sponsored retirement savings while working. They quantify the benefit as the reduction in average annual lifetime federal income tax rate. They assume a base case of 40 work years (ages 25-65) and a number of retirement years equal to life expectancy minus 65. Using the complete time-series of U.S. income tax history (with focus on 2010 tax tables), they find that:

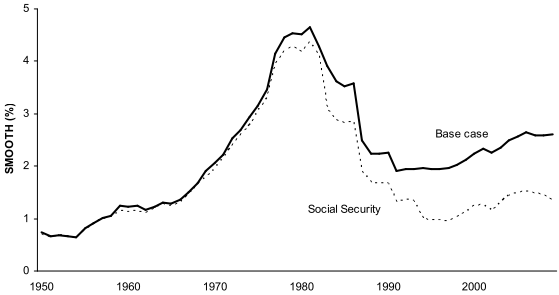

- Under arguably extreme behavioral assumptions that entail planning from the time an individual starts working until death, the typical U.S. worker presently can reduce expected average annual lifetime federal income tax rate by no more than 1%-2% (see the chart below).

- Two main constraints limit the benefit from shifting income from work years to retirement:

- U.S. tax brackets are not progressive enough to generate a large benefit.

- Social Security taxability partly “uses up” low tax brackets during retirement years.

- Findings are mostly robust to the magnitudes of a variety of modeling parameters such as real return on retirement savings, income growth, life expectancy, savings rate and number of years spent saving for retirement.

The following chart plots the approximate reduction in average annual lifetime federal income tax rate (SMOOTH) available to individuals in the U.S. during 1950 through 2010, estimated with (dashed line) and without (solid line) Social Security. Calculations assume: 40 work years, followed by life expectancy minus 65 retirement years; income of GDP per capita times five; and, real return on retirement savings of zero. Features of the plots include:

- The overall upward trend in the solid line derives from increasing life expectancy (more retirement years).

- The peak at about 1980 results from prior inflation-driven bracket creep (tax tables change little from 1950 to 1980) and the subsequent 1986 reduction in income tax progressivity and indexation of brackets to inflation.

- The effect of Social Security changes in 1983 and 1994, when the payments become increasingly taxable, thereby “using up” lower tax brackets (and recapturing the deferred taxes in a higher bracket).

- A positive real return on retirement savings would boost taxable retirement income and therefore further reduce the benefit of tax-deferred retirement savings.

In summary, evidence from simple modeling suggests that a realistic expected benefit from tax-deferred retirement savings in the U.S. is a roughly 1% decrease in average lifetime income tax rate.

The number of financial, regulatory and political moving parts in this calculation (income variability, real return on retirement savings, potential changes in the level and taxability of Social Security benefits, potential changes in federal income tax levels and brackets, state income taxes…) substantially blurs the expected benefit of tax-deferred retirement savings.