How do gold and gold miner stocks interact? In his February 2014 presentation package entitled “A Golden Bet: Gold Miner Equities versus Gold”, Claude Erb examines the long-run relationship between gold and a gold miner stock indexes. He relies mostly on in-sample regressions over a 20-year sample period. Using monthly gold price and gold miner index level during September 1993 through October 2013, he finds that:

- Prospects for gold and gold miner stocks depend on beliefs (see the first chart below):

- If gold price determines the value of gold miner stocks, the price of gold suggests a near-term return on gold miner stocks of 100%.

- If gold miner stocks lead gold price, the level of gold miner stock indexes suggests a near-term 50% drop in gold price.

- However, belief in an equilibrium gold-gold miner stocks relationship is an act of faith, not fact.

- Gold miner “gold beta” declines as investment horizon increases. In other words, gold miners tend to be a leveraged play on gold in the short run, but the leverage dissipates as holding period increases.

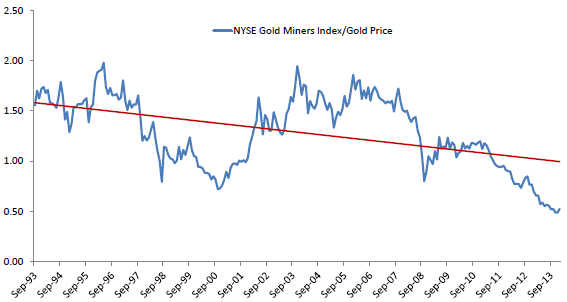

- Though gold over the long run retains roughly constant buying power, the gold miners-gold ratio declines over time (see the second chart below). In other words, gold miner stocks appear to be long-term depleting assets.

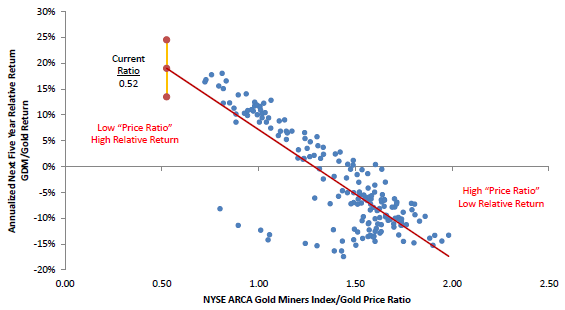

The following chart, taken from the presentation package, depicts the relationship between annualized five-year future performance of a gold miner index relative to gold and the gold miner index-gold ratio over the past 20 years. For example, the first data pair shows the gold miner index-gold ratio for September 1993 and the annualized five-year return ratio for September 1993 through September 1998. Measurements are overlapping.

Results suggest that gold miner stocks outperform gold over the next five years when the beginning gold miner index-gold ratio is less than about 1.25. The chart also shows that the gold miner index-gold ratio at the end of October 2013 is 0.52.

The next chart, also from the package, shows the trend in the gold miner index-gold ratio over the sample period. The indicated decline suggests that gold miner stocks are depleting assets, perhaps because mines eventually become exhausted.

In summary, evidence suggests that: (1) there is no stable relationship between gold and gold miner stock prices; (2) the “gold leverage” of gold miner stocks fades with holding period; and, (3) gold miner stocks may be depleting assets.

Cautions regarding findings include:

- The sample period is modest for long-run ratio analysis, likely sensitive to the start date of available data.

- Analyses supporting findings are in-sample regressions and test no trading strategies.