Do central banks predictably influence the price of gold? In the July 2016 revision of his paper entitled “Central Banks and Gold”, Dirk Baur examines interactions of central bank gold reserves, gold carry trade profitability and gold price. Using monthly data for central bank gold reserves and gold prices since 1968 and for 1-month and 6-month gold lease rates since 1989, as available through 2015, he finds that:

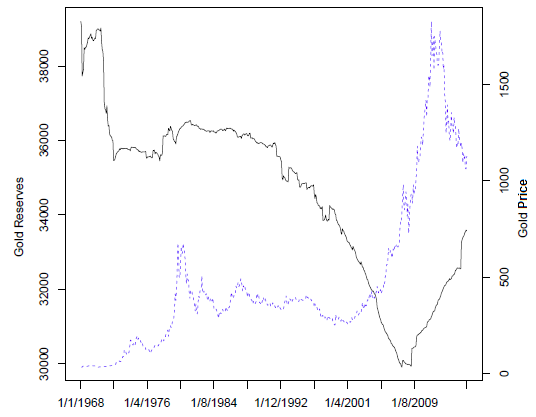

- The long-term relationship between aggregate world central bank gold reserves and gold price (see the chart below) suggests that the market can absorb central bank gold sales without price impact, but that central bank purchases drive gold price up. Quantile regressions support the observation that central banks can enforce a price floor but not a price ceiling.

- The gold carry trade explains both the stable gold price during the 1980s-1990s and the bull market in the 2000s.

- High lease rates and stable gold price until about 2000 suggest an active gold carry trade profitable for both gold lenders and borrowers, with associated short selling of significant fractions of world gold reserves.

- Declining gold lease rates and rising gold price in the 2000s create positive feedback via covering of short gold positions.

The following chart, taken from the paper, tracks aggregate world central bank gold reserves in metric tons (left axis) and the price of gold in dollars per ounce (right axis). There is no consistent relationship between the two series for the overall 1968-2015 sample period. During 1996-2000 and 2009-2011 subperiods, the relationship is positive. During 2002-2008 and 2012-2015, the relationship is negative.

In summary, evidence suggests that world central banks in aggregate have some ability to stabilize a falling gold price both through adjusting position in and lending of gold, but not much ability to suppress a rising gold price.

Cautions regarding findings include:

- Statistical findings in the study are generally weak and undermined by inconsistencies in the relationship between central bank reserves and gold price.

- The study does not consider any strategies for exploiting central bank behaviors, noting instead that the banks prefer to keep their actions secret.

- Central bank reserve estimates may not be reliable.