Are realized (actual historical) and implied volatilities the whole story for equity option valuation? In their December 2011 paper entitled “Fundamental Analysis and Option Returns”, Theodore Goodman, Monica Neamtiu and Frank Zhang investigate the extent to which the equity options market fails to recognize volatility of firm operations (accounting data) and whether any such failure is exploitable. They focus tests on long, one-month-to-expiration, at-the-money straddles (long both a call and a put), which profit from large moves in underlying stock prices. They estimate future volatility in firm fundamentals via regression based on a combination of short-term sales/earnings growth and long-term sales/earnings growth volatility (standard deviation over the last six years). They isolate a “pure” expected fundamental volatility via regression versus implied volatility and the implied-realized volatility gap. Using data as available to estimate the relationship between fundamental volatility and returns on options for individual U.S. stocks during January 1996 through September 2010 (52,251 firm-quarters involving 3,481 distinct firms), they find that:

- Implied and realized stock price volatilities do not fully impound expectations for volatility in firm fundamentals.

- The ability of expected fundamental volatility to help explain actual future stock price volatility is a profit opportunity:

- A hedge portfolio that is long (short) straddles for the stocks in the highest (lowest) tenth of purified expected fundamental volatilities, reformed monthly, generates an average monthly gross return of 8.0% (2.2% from the long side and 5.8% from the short side). Over 60% of monthly gross returns are positive, but the maximum monthly drawdown is over 40%.

- Relaxing the hedge portfolio threshold to the top and bottom 30% of purified expected fundamental volatilities reduces average monthly gross return to 5.4%. Over 60% of monthly gross returns are again positive, and the maximum monthly drawdown is less than 30%.

- Expanding fundamental volatility calculations beyond sales and earnings to include accruals, capital expenditures and external financing tends to improve profitability.

- A double sort, first by deciles on the implied-realized volatility gap and then by terciles on purified expected fundamental volatility enhances trading returns. A hedge portfolio that is long (short) straddles for for stocks in the high-gap, high-expected fundamental volatility (low-gap, low-expected fundamental volatility) grouping, reformed monthly, generates an average monthly gross return of 27.3% (compared to 20.0% for a portfolio using only the implied-realized volatility gap).

- However, conservatively assuming that traders lose the entire bid-ask spread indicated by closing data:

- The average monthly return for the hedge portfolio based on extreme deciles of purified expected fundamental volatility drops from a gross 8.0% to a net -9.3%.

- The average monthly return for the double-sort hedge portfolio drops from a gross 27.3% to a net 6.7%.

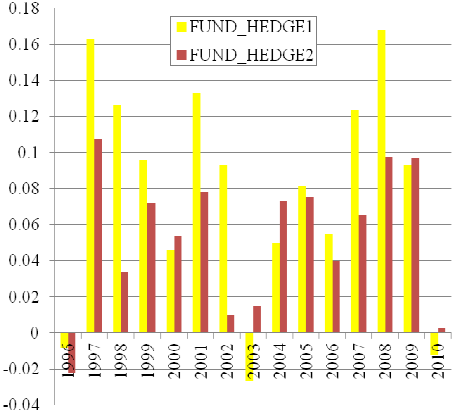

The following chart, taken from the paper, shows average monthly gross returns by calendar year for two hedge portfolios consisting of straddles for individual U.S. stocks, reformed monthly. FUND_HEDGE1 is long (short) straddles for stocks with highest (lowest) tenth of purified expected fundamental volatilities. FUND_HEDGE2 is long (short) straddles for stocks with highest (lowest) third of purified expected fundamental volatilities. FUND_HEDGE1 (FUND_HEDGE2) is profitable at a gross level in 12 (14) of 15 years, and the bad years are not very bad.

In summary, evidence indicates that option traders may be able to exploit the volatility of firm accounting data to enhance profitability of trading the options of associated stocks.

Cautions regarding findings include:

- Data collection and processing to support the trading strategy described would be burdensome.

- The estimated trading friction ignores broker fees.

- Return calculations appear not to account for capital reserves required to buffer extreme drawdowns in option positions. Accounting for such reserves (earning the risk-free yield) would lower overall portfolio returns.