Are expert technicians or fundamentalists better forecasters of short-term and intermediate-term asset returns? In the August 2015 version of their paper entitled “Talking Numbers: Technical versus Fundamental Recommendations”, Doron Avramov, Guy Kaplanski and Haim Levy assess the economic value of dual technical and fundamental recommendations presented simultaneously on “Talking Numbers”, a CNBC and Yahoo joint broadcast… “featuring fundamental and technical recommendations before and during the market open. Dual recommendations are made by highly experienced analysts representing prominent institutions.” Recommendations address both individual stocks and asset classes, including U.S. and foreign broad equity indexes, sector/industry equity indexes, bonds, commodities and exchange rates. Using 1,000 dual recommendations on 262 stocks and 620 dual recommendations on other assets, along with associated price data, during November 2011 through December 2014, they find that:

- Technicians strongly outperform fundamentalists in predicting returns of individual stocks over horizons of three to nine months. Specifically, over the nine months after recommendations (see the charts below):

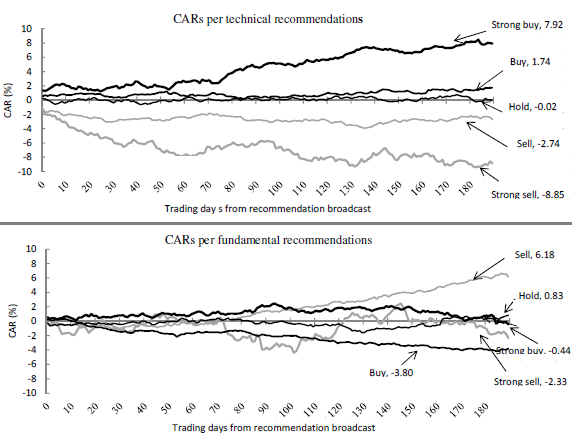

- Strong sell, sell, hold, buy, and strong buy technical recommendations generate average gross cumulative abnormal returns (CAR) of -8.85%, -2.74%, -0.02%, +1.74% and +7.92%, respectively.

- Strong sell, sell, hold, buy, and strong buy fundamental recommendations generate average gross CARs of -2.33%, +6.18%, +0.83%, -3.80% and -0.44%, respectively.

- Compared to fundamental analysis, technical analysis generates (1) a higher win rate (correct direction), (2) larger gains after correct recommendations and (3) smaller losses after incorrect recommendations.

- The strong performance of expert technical stock pickers is robust to controlling for common risk factors (size, book-to-market, momentum, volatility, trading volume), firm characteristics, industry effects, analyst gender, immediate impact of broadcast, trading frictions and outliers.

- Neither technical nor fundamental perspectives produce good forecasts of U.S. and foreign broad equity indexes, sector/industry equity indexes, bonds, commodities or exchange rates.

The following charts, taken from the paper, compare average gross CARs (relative to the market return) during the nine months (189 trading days) after strong sell, sell, hold, buy, and strong buy recommendations based on technical analysis (upper chart) and fundamental analysis (lower chart) as broadcast on “Talking Numbers” during November 2011 to December 2014. Over the investment horizon, expert technicians exhibit strong stock-picking skills, but expert fundamentalists do not.

In summary, evidence indicates that expert technicians exhibit significant stock-picking skills at horizons of three to nine months, but expert fundamentalists do not. Neither show ability to predict asset classes/industry returns at these horizons.

Cautions regarding findings include:

- Technical and fundamental analyses may have inherently different effective forecast horizons, with the latter tending to be long-term.

- Returns are gross, not net. Accounting for trading frictions to exploit recommendations would reduce reported returns, but frictions are small compared to average gross returns for strong buy and strong sell signals based on expert technical analysis.

- The sample period offers little variety in market/economic environments. Predictive power may concentrate during certain environments.