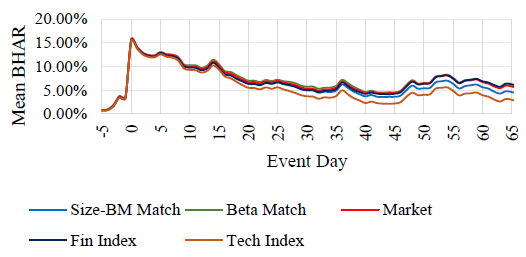

How does the market react when firms announce adoption of blockchain technology? In the May 2019 draft of their paper entitled “Bitcoin Speculation or Value Creation? Corporate Blockchain Investments and Stock Market Reactions”, Don Autore, Nicholas Clarke and Danling Jiang study stock price reactions to initial public announcements of investments in blockchain technology by listed U.S. firms. Their key metric is buy-and-hold abnormal return (BHAR) relative to each of five benchmarks: (1) portfolios of stocks matched on size and book-to-market (BM); (2) portfolios of stocks matched on market beta; 3) a broad value-weighted market index; (4) iShares Global Financials ETF (IXG); and, (5) iShares Global Tech ETF (IXN). Their announcement event windows is five trading days before initial public announcement of an investment in blockchain technology (-5) to 65 trading days after (65). Using dates of initial public announcements of investments in blockchain technology and contemporaneous daily returns for 207 stocks listed on NYSE and NASDAQ during October 2008 through March 2018, they find that:

- For the full sample, average initial stock reaction is an immediate 15% BHAR, followed by 10% reversal over the next month (see the chart below).

- This effect is stronger, with muted reversal, among stocks of firms at an advanced stage of blockchain investment and firms that confirm the investment in subsequent financial statements. For example, the 54 (162) firms announcing advanced (preliminary) investments have average -5 to +5 trading day BHAR 32% (7.3%) and -5 to -65 trading day BHAR 18% (0.9%).

- The effect concentrates among lottery-type stocks (low price, high idiosyncratic volatility and high idiosyncratic skewness). Specifically:

- Stocks with the lowest (highest) third of prices at announcement have average -5 to +5 trading day BHAR 39% (-0.4%) and average -5 to -65 trading day BHAR 15% (-1.3%).

- Stocks with the lowest (highest) third of idiosyncratic volatilities, measured over the prior 125 trading days, have average -5 to +5 trading day BHAR 39% (0.0%) and average -5 to -65 trading day BHAR 18% (-1.2%).

- Stocks with lowest (highest) idiosyncratic skewness, measured over the prior 125 trading days, have average -5 to +5 trading day BHAR 27% (2.9%) and average -5 to -65 trading day BHAR 11% (3.6%).

- Stocks with initial blockchain investment announcements made during the top (bottom) third of prior-month Bitcoin returns have average -5 to +5 trading day BHAR 37% (0.8%) and average -5 to -65 trading day BHAR 6.0% (3.5%).

- Stocks of the 43 (164) firms with initial blockchain investment announcements covered (not covered) by major media have average -5 to +5 trading day BHAR 31% (8.0%) and -5 to -65 trading day BHAR 5.1% (4.5%).

- After announcement, stocks of firms investing in blockchain technology track Bitcoin price more closely than before.

The following chart, taken from the paper, plots full sample average BHARs for all five benchmarks over the 70 trading day event window. Notable points are:

- The initial reaction of 15% BHAR is sharp and may involve large gaps at announcement, but it appears there may be some insider anticipation of the announcement effect.

- Reversal of about 10% ensues over the next two months, with most of the reversal occurring during the first month.

- Findings are not sensitive to the choice of benchmark for calculating BHAR.

In the absence of refinements, it appears that most investors can exploit only reversal of the initial blockchain announcement effect by shorting for about a month after announcement.

In summary, limited evidence suggests that traders may be able to exploit initial firm announcements of investment of blockchain technology by selectively shorting associated stocks (e.g., low-priced) if Bitcoin return has recently been strong.

Cautions regarding findings include:

- The sample is small for the degree of parsing applied. Looking for effects among many modest subsamples introduces data snooping bias.

- Reported returns are gross, not net. Accounting for the costs of trades to exploit findings would reduce returns. Moreover, trading frictions may be unusually high around announcements, and the effect concentrates among stocks that may be difficult/costly to short.

- The test based on subsequent firm financial reports is not exploitable.

- As blockchain announcements proliferate, market reactions may weaken. The authors do not address whether the effect weakens over time.