Do stocks added to major indexes, such as the S&P 500 Index, exhibit exceptionally strong subsequent returns? In their July 2020 paper entitled “Does Joining the S&P 500 Index Hurt Firms?”, Benjamin Bennett, René Stulz and Zexi Wang investigate effects on firms/stocks of joining the S&P 500 Index and whether these effects change over time. They estimate abnormal stock performance using both market-adjusted returns and alphas from 3-factor (market, size, book-to-market), 4-factor (adding momentum) or 5-factor (adding profitability and investment instead of momentum) models of stock returns. Using monthly and daily fundamentals and price data for 659 firms/stocks added to the S&P 500 Index during 1997 through 2017, they find that:

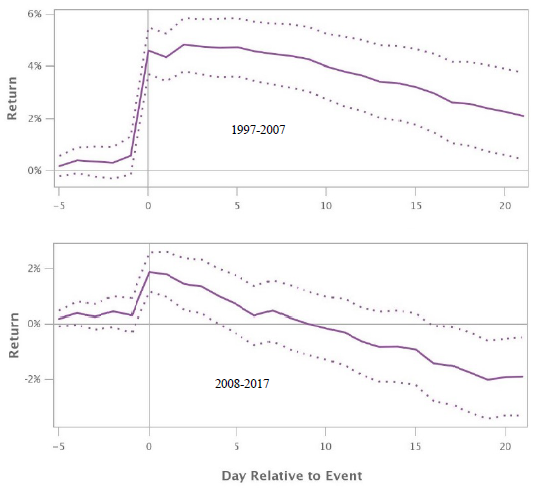

- Adding a stock to the S&P 500 Index has markedly different effects on returns during the first (1997-2007) and second (2008-2017) halves of the sample period. Specifically:

- From five trading before through five trading days after announcement, average cumulative abnormal returns (CAR) range from 4.7% to 4.9% across the four measurement methods during the first half of the sample period, but only 0.6% to 0.7% during the second half.

- From five trading before through 21 trading days after announcement, CARs range from 2.0% to 2.4% during the first half, but -2.3% to -2.1% during the second half (see the charts below).

- During the year after announcement, CARs are approximately zero for the first half, but ranges from -0.63% to -0.73% monthly during the second half.

- After addition, firm equity issuance tends to fall, and both dividends and stock repurchases tend to rise. Firm return on assets tends to decline.

The following charts, extracted from the paper, compare average CARs (based on 4-factor alphas) for stocks added to the S&P 500 during 1997-2007 (upper chart) and during 2008-2017 (lower chart) from five trading days before through 21 trading days after announcement date (the event). The first trading day following the (after-hours) announcement is day 0. Dotted lines denote 95% confidence intervals around averages. Results indicate that addition to the S&P 500 Index used to be a positive over this interval, but is now a negative.

In summary, evidence indicates that the conventional wisdom regarding abnormal positive returns for stocks added to major indexes has expired.

Cautions regarding findings include:

- Reported returns are gross, not net. Accounting for frictions from trades to exploit findings would lower returns.

- The day 0 gap up in prices for added stocks is likely unexploitable without foreknowledge of announcements.

- Reliably exploiting average effects across many stocks requires a large number of trades, many likely coinciding at index rebalancing events, such that keeping capital available for exploitation would lower portfolio-level return.

See also: