Do stocks around the world tend to perform better around the time of annual earnings announcements by respective firms than during the rest of the year? In the June 2011 draft of their paper entitled “The Earnings Announcement Premium Around the Globe”, Brad Barber, Emmanuel De George, Reuven Lehavy and Brett Trueman investigate whether the earnings announcement premium (elevated returns during earnings announcement months) is a global phenomenon or is isolated to U.S. stocks. They employ a hedge portfolio, reformed monthly, that is long (short) stocks of firms expected (not expected) to announce annual earnings during the next month, The long and short sides are equal-weighted, and the stocks within each side are value-weighted. Using roughly 200,000 annual earnings announcements for about 28,000 firms in 46 countries during 1990 through 2009 to estimate announcement months during 1991-2010, and associated monthly stock returns, they find that:

- The average gross raw return for the above hedge portfolio that is long (short) announcing (non-announcing) stocks each month is 0.67% per month (8.0% annualized).

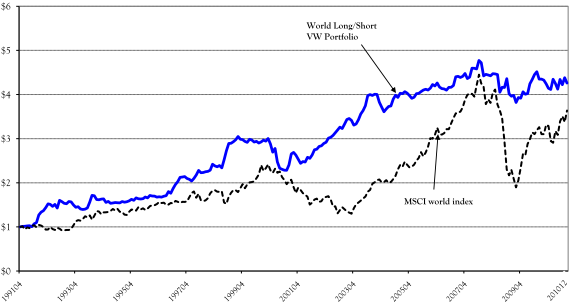

- A $1 investment in the hedge portfolio at the beginning of 1991 grows to $4.26 by the end of 2010 on a gross basis, compared to $3.64 for a passive global portfolio weighted equally by country (see the chart below). The gross Sharpe ratio of the hedge portfolio is more than 40% higher than that of the passive global portfolio over this period.

- Controlling for size (market capitalization), book-to-market ratio and momentum increases gross outperformance to 0.95% per month (11.5% annualized). This gross alpha is:

- Positive in all 20 years in the sample period and significant in 16 of the 20 years.

- Positive in 16 of the 20 countries with the largest numbers of observations and significant in nine (with magnitudes in these nine larger than that estimated for U.S. firms).

- Most pronounced for the smallest firms, with the difference between the premium for the smallest and largest 20% of market capitalizations about 6% annualized.

- There is evidence of an increase in investor attention to firms around earnings announcements, creating upward pressure on stock prices. There is no evidence that elevated systematic or idiosyncratic risk drives the effect.

The following chart, taken from the paper, shows the gross cumulative values during 1991 through 2010 of: (1) the above hedge portfolio that is long (short) announcing (non-announcing) stocks each month; and, (2) buying and holding the Morgan Stanley Capital International (MSCI) value-weighted global index (excluding the U.S.). Results show that the hedge portfolio generally beats the passive investment on a gross basis, most dramatically during bear markets.

In summary, evidence indicates that investors may gain an edge by systematically implementing purchase (disposition) decisions for individual stocks somewhat before (after) earnings announcements.

Note that return calculations in this study are gross, not net. Including reasonable trading frictions for reforming the test portfolio monthly (with extensive weighting adjustments required) would materially reduce performance of the active hedge portfolio. Trading frictions tend to be higher for small capitalization stocks (for which the earnings announcement premium is larger) than large capitalization stocks.

See “Testing Earnings Season (Alcoa to Wal-Mart) Trading Strategies” and “Stock Returns During and Between Earnings Seasons” for definitions and quantification of returns during aggregated earnings announcement season and off-season for the U.S. market.