Value investing performance over the past two decades is poor. Is this underperformance a temporary consequence of an unusual macro environment, or a reflection of permanent economic/equity market changes. In their February 2021 paper entitled “Value Investing: Requiem, Rebirth or Reincarnation?”, Bradford Cornell and Aswath Damodaran survey the history and alternative approaches to value investing, with focus on its failure in recent decades. They then discuss how value investing must adapt to recover. Based on the body of value investing research through 2020, they conclude that:

- Academics disagree about whether the value premium is a proxy for risk or a sign of market inefficiency. The latter explanation underpins value investing.

- The contest between value and growth investing is where to look for valuation errors. Value investors focus on errors in valuing current tangible assets, thereby concentrating on mature companies and missing technology booms. Growth investors argue that valuing growth is more difficult than valuing assets in place and therefore a more likely source of valuation errors.

- Historically, value (growth) wins when: (1) earnings growth is relatively high (low); and, (2) the slope of the yield curve is upward (flat or downward).

- During 2010-2019, the great majority of value fund managers (79%-92% across size categories) fail to beat their value index benchmarks on a net basis. Even gross of fees, percentages of fund managers beating their indexes is well below 50%.

- Even during the COVID-19 crisis (mid-February through October 2020), stocks with low price-to-earnings and price-to-book ratios underperform.

- Value investors must:

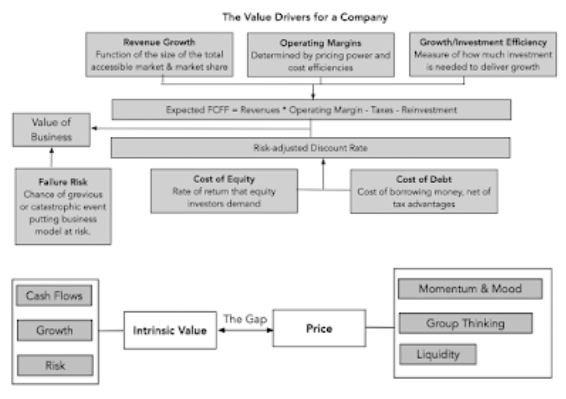

- Understand that value is a function of cash flows, growth and risk (see the figures below). A valuation model that does not explicitly forecast cash flows or adjust for risk is inadequate.

- Adopt decision trees and Monte Carlo simulation methodologies to deal with firm-specific and macroeconomic uncertainties in valuations.

- Avoid a margin of safety that is so large it leads to cash hoarding.

- Recognize that valuation of future growth is a complex forecasting issue, not an accounting issue.

- Reject the belief that value investing means concentration in a few best ideas. Diversification is key to surviving risks.

- Dismiss the feeling that value investing is virtuous. The only reason to believe that value investing is better than another approach is superior risk-adjusted returns.

The following figures, taken from the paper, summarize company valuation (upper figure) and the investment decision (lower figure) as key value investing subprocesses.

In summary, value investing is failing due to dependence on metrics that are less and less meaningful as the global economy/equity market evolves. Value investors should include intangible assets and adopt new methods to quantify uncertainty.

Cautions regarding conclusions include:

- The paper is largely an historical survey and statement of beliefs. The authors do not demonstrate that applying these beliefs generate attractive returns.

- Adoption of new methods requires investment in tools and learning. Some investors may instead have to bear fees to gain access to such investments via funds, and identifying funds that will be successful in remaking value investing is problematic.