Given the conflicting evidence about the import of the size effect, is there a way investors can extract a reliable premium from small stocks? In their January 2015 draft paper entitled “Size Matters, If You Control Your Junk”, Clifford Asness, Andrea Frazzini, Ronen Israel, Tobas Moskowitz and Lasse Pedersen examine whether controlling for firm quality mitigates the following seven unfavorable empirical findings that the size effect:

- Is weak overall in the U.S.

- Has not worked out-of-sample and varies significantly over time.

- Only works for extremely small stocks.

- Only works in January.

- Only works for market capitalization-based measures of size.

- Is subsumed by illiquidity.

- Is weak internationally.

They control for quality using a Quality-Minus-Junk (QMJ) factor based on profitability, profit growth, safety and payout. They use a portfolio test approach, ranking stocks into value-weighted tenths (deciles) each month to examine differences among stocks sorted by factor. Focusing on returns and factor metrics for a broad sample of U.S. common stocks during July 1957 (when quality metrics become available) through December 2012 and for 23 other developed country stock markets during January 1983 through December 2012, they find that:

- Over an extended sample period from July 1926 through December 2012, the size effect is moderately significant (the average month gross return spread between extreme small-big deciles is 0.55%) but derives entirely from returns in January and varies substantially over time.

- During July 1957 through December 2012:

- Stocks with very low quality are typically very small, have low average returns and are distressed and illiquid. This negative size-quality relationship largely explains unfavorable findings for the size effect.

- Controlling for quality via the QMJ factor, the gross size effect is:

- Economically large and statistically significant (about double the uncontrolled size effect).

- Stable over time and across different measures of size, calendar seasons, U.S. industries and international markets.

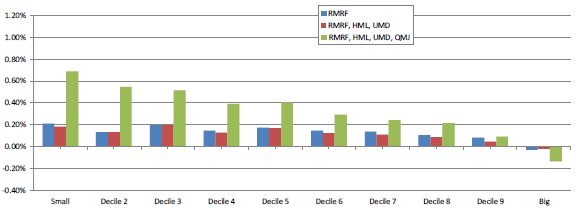

- Systematic across size deciles rather than concentrated among tiny firms (see the chart below).

- Less exposed to liquidity measures, implying practical exploitability.

- Controlling for quality also explains interactions between size and other factors such as value and momentum. Specifically, controlling for quality explains why conventional factor models overstate (understate) expected returns for small growth (value) stocks.

The following chart, taken from the paper, summarizes gross alphas of stock size deciles with respect to three factor models of U.S. stock returns during July 1957 through December 2012:

- Adjusted for broad stock market return minus the risk-free interest rate (RMRF)

- Adjusted also for short-term reversion, value and momentum factors (RMRF, HML, UMD).

- Even further adjusted for the quality factor (RMRF, HML, UMD, QMJ).

Results indicate that adjustment for the quality factor gives a large boost to the size effect and makes it much more systematic across size deciles.

In summary, evidence indicates that controlling for quality produces a robust size effect that is on roughly equal footing with value and momentum, and potentially exploitable.

Investors may want to consider screening for small, high-quality stocks.

Cautions regarding findings include:

- As noted, portfolio/factor returns are gross, not net. Accounting for the costs of monthly portfolio reformation and shorting costs for long-short portfolios would reduce returns. Shorting of some stocks in long-short portfolios may not be feasible.

- Snooping many factors and factor combinations introduces snooping bias, such that the best models likely overstate predictive power.

- The study does not demonstrate that the quality-controlled size effect is exploitable, but the strong performance of the first decile in the chart above is promising for a long-only approach.