Does P/E10, current real (inflation-adjusted) level of a stock market index divided by associated average real earnings over the last ten years, usefully predict stock market returns for non-U.S. markets? In the July 2012 revision of his paper entitled “Does the Shiller-PE Work in Emerging Markets?”, Joachim Klement assesses the validity of P/E10 as a long-term stock market return predictor in local currencies for 19 developed and 16 emerging equity markets. He calculates P/E10 in each market monthly using overlapping return and earnings measurement intervals. Using monthly data for country stock market indexes, earnings and inflation as available (with start dates ranging from January 1910 for the U.S. to January 2005 for China and Columbia) through April 2012, he finds that:

- Based on overlapping monthly measurements in local currencies:

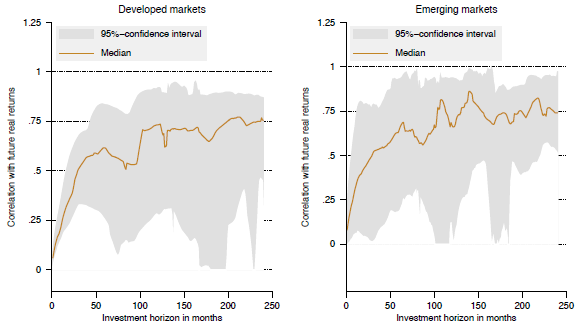

- The median correlation across countries between P/E10 and future real stock market returns is low for investment horizons under five years, but generally around 0.7 for horizons of five to 20 years in both developed and emerging markets. However, variability across countries is high, undermining confidence in this median (see the charts below).

- Among the 19 developed (12 emerging) countries for which there are enough data, lagged P/E10 explains as much as 90% (93%) and as little as 3% (0%) of 10-year future real stock market returns, with median 53% (42%). For consolidated value-weighted (equal-weighted) developed and emerging market indexes, P/E10 explains 86% (6%) and 67% (18%) of 10-year future real stock market returns, respectively.

- Based on non-overlapping 10-year measurement intervals (eliminating statistical distortions from sampling overlap), P/E10 explains 23% of 10-year future real returns across all countries on an equal-weighted basis, 33% for developed markets and 11% for emerging markets.

- High GDP growth, low inflation and high real interest rates relate to high P/E10, with the interest rate relationship weaker than those of GDP growth and inflation. Current country GDP growth, inflation and real interest rate data indicate that P/E10 is substantially too low for Eurozone markets, substantially too high for the U.S. and too high for most emerging markets, suggesting other important determinants of P/E10.

- Based naively on P/E10 alone, expected real long-term stock market returns are generally positive. However, in a regime of rising interest rates and weak GDP growth, very limited data predict generally negative real stock market returns except for the Eurozone and Brazil.

The following charts, taken from the paper, show median correlations between P/E10 and future real stock market return in local currency at horizons ranging from one to 240 months across developed markets (left chart) and emerging markets (right chart) over available sample periods. Shaded areas indicate 95% confidence intervals around medians. Median results suggest that P/E10 is a useful predictor of future returns for horizons of about five years and longer, but the very wide confidence intervals indicate considerable uncertainty in these median correlations even at long investment horizons.

In summary, evidence from samples of mostly very limited durations indicates that P/E10 has value as a long-term predictor of real stock market performance in local currencies worldwide, with some macroeconomic indicators such as GDP growth and inflation useful modifiers.

Cautions regarding findings include:

- It is not obvious that P/E10 has a stable, predictable average. Consequently, an investor operating in real time during the various country sample periods may well set different thresholds for high and low P/E10 at different times, confounding use of P/E10 for market timing. See “P/E10 and Future Stock Market Returns”, which includes investigations of out-of-sample exploitability of the in-sample predictive power of P/E10 with respect to nominal U.S. stock market returns.

- As noted in the paper, sample periods are short for many markets in terms of number of economic cycles and, especially, in terms of independent ten-year measurement intervals in each country. There is unresolved autocorrelation in consolidated data since country markets are not completely independent of each other, thereby potentially overstating the magnitude and reliability of P/E10’s in-sample explanatory power overall and for developed and emerging market indexes. Also, the data consolidation approach gives very heavy emphasis to the U.S. and to the last one or two decades because long samples do not exist for most countries.

- Economic growth and inflation may also co-move across countries, effectively reducing subsample sizes for associated analyses of the interplay of economic factors with P/E10.

- The study employs indexes rather than tradable assets, tending to overstate the returns an investor would experience with trading frictions and management fees.

- Currency exchange rate movements may offset country returns for global investors.