Economic data arrive too slowly to help investors navigate crises such as the 2019 coronavirus (COVID-19) outbreak. Are there data that support quick reactions? In their March 2020 paper entitled “Coronavirus: Impact on Stock Prices and Growth Expectations”, Niels Gormsen and Ralph Koijen employ equity index dividend futures by maturity to understand the evolution of investor reactions to COVID-19 outbreak and subsequent policy actions. They argue that a stock market decline means that expected future dividends fall and/or the discount rate for future dividends rises, differently by maturity. These changes in expectations affect stock market valuation. Using daily dividend futures closing mid-quotes in the U.S. and settlement prices in the EU during January 2006 through March 25, 2020, they find that:

- Based on out-of-sample regression modeling, expected dividend growth rate over the next year falls by 28% in the U.S. and 22% in the EU from January 1, 2020 to March 25, 2020. Corresponding expected GDP growth is down 2.2% in the U.S. and 2.8% in the EU.

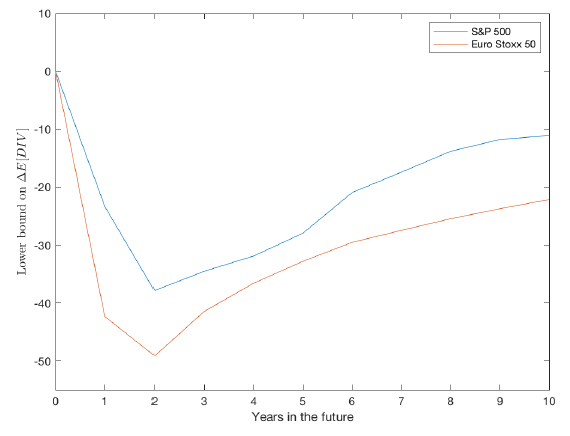

- Based solely on changes in dividend futures prices from January 15, 2020 to March 25, 2020, deterioration in expected dividends is -38% in the U.S. and -49% in the EU over the next two years (relative to initial expectations). The corresponding change in expected dividends during November 2008 of the global financial crisis is -30%, an accurate forecast of the actual decline in dividends through 2010.

- There are signs of catch-up growth in future years three to 10 (see the chart below), possibly due to anticipation of a vaccine.

- Market and dividend futures reactions jointly suggest that long-horizon discount rates have increased substantially since early 2020.

The following chart, taken from the paper, shows changes in expected dividends over the next 10 years for the S&P 500 and the Euro Stoxx 50 based solely on changes in respective dividend futures prices during January 15, 2020 through March 25, 2020. These graphs represent lower bounds in expected dividends relative to previous expectations. The deepest drops in expectation are at a 2-year horizon (-38% for the S&P 500 and -49% for the Euro Stoxx 50). There are signs of catch-up growth during years 3 through 10.

In summary, evidence suggests that the impact of COVID-19 and associated policy reactions on expected stock market dividends, and thereby potentially on market valuations, is similar to that of November 2008 during the first two years, with relatively stronger recovery thereafter.

Cautions regarding findings include:

- Samples are short in terms of variety of market conditions.

- Model verification regarding dividend expectations consists of a single prior market crash.