What is growth investing, and how well does it work? How can investors enhance this investment style? In his July 2012 paper entitled “Growth Investing: Betting on the Future?”, Aswath Damodaran examines different approaches to growth investing: focusing on companies with small market capitalization; playing initial public offerings (IPO); seeking growth at a reasonable price (GARP); and, activist venture capital-like investing. He defines growth investing as pursuit of market undervaluation of future growth, looking for bargains based on overlooked growth potential. Based on the body of growth investing research, he finds that:

- The simplest growth strategy is investing in small growth companies. Data indicate that small growth investing success requires: a very long investment horizon; disciplined diversification across sectors/industries; and, considerable due diligence in stock selection due to lack of analyst coverage.

- Playing IPOs is an ancillary strategy (due to unpredictable availability of opportunities). Data indicate that IPO investing success requires: valuation skills; ability to assess general market appetite for IPOs and demand for each offering; understanding the IPO allotment game; and, playing globally as IPOs increasingly shift to emerging markets.

- Regarding GARP strategies:

- Due to mean reversion, past earnings growth is not a reliable indicator of future earnings growth, and investing in companies with high past growth does not yield significant returns.

- The performance of a strategy based on buying stocks with a price-earnings ratio (PE) lower than the expected earnings growth rate is sensitive to interest rates, performing well (poorly) when rates fall (rise).

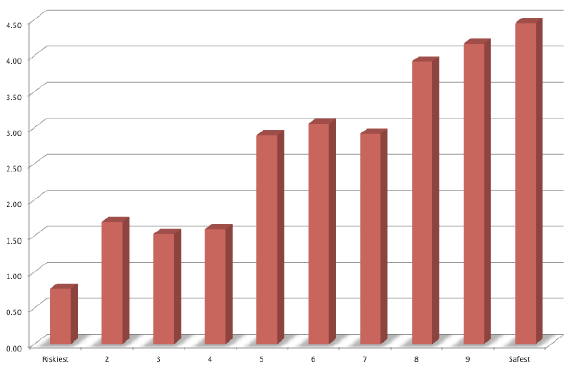

- The strategy of buying stocks with a low PE to earnings growth ratio (PEG) tends to produce a portfolio of stocks with high risk (high volatility) and high growth that are not undervalued (see the chart below). Investors following a low-PEG strategy should adjust for stock riskiness.

- Growth (value) stocks seem to do much better when aggregate market earnings growth is low (high) and when the yield curve is flat or downward sloping (upward sloping).

- Momentum effects may be especially strong for stocks of high-growth companies. Thus, combining a growth screen with a momentum screen (such as relative strength) may enhance the growth strategy.

- In general:

- Growth investors who cannot themselves estimate expected company earnings growth rates should focus on sources with the best track records for accurate forecasts.

- A long time horizon increases the odds of success.

The following chart, taken from the paper, summarizes average PEG as of January 2011 for U.S. stocks by risk decile, with risk defined by standard deviation of returns. Portfolios of low-PEG stocks tend to be relatively risky, working against the higher average returns of such portfolios. Investors focusing on PEG should therefore also screen for low stock volatility.

In summary, the body of research indicates that growth investing mostly underperforms value investing, but there are periods/conditions/situations under which growth does well.

Cautions regarding findings include:

- Return analyses are gross, not net. Including reasonable trading frictions, which vary considerably across categories of stocks (such as small versus big) and over long samples, may affect findings.

- Discussions are generally conceptual rather than applied.