Does duration (relative arrival sequence) of firm cash flows explain many widely accepted equity factor returns? In their April 2019 paper entitled “Duration-Driven Returns”, Niels Gormsen and Eben Lazarus investigate whether firm cash flow duration explains value, profitability, investment, low risk, idiosyncratic volatility and payout factor returns. They measure cash flow duration monthly via multiple regressions that relate analyst long-term growth estimates for each firm to its profitability, investment, low risk (market beta), idiosyncratic volatility and payout. They then each month for U.S. and global stocks separately reform four value-weighted sub-portfolios:

- Above-median NYSE market capitalization and top 30% of duration.

- Above-median NYSE market capitalization and bottom 30% of duration.

- Below-median NYSE market capitalization and top 30% of duration.

- Below-median NYSE market capitalization and bottom 30% of duration.

They specify the duration factor as return to a portfolio that is each month long (short) the two equal-weighted long-duration (short-duration) sub-portfolios. As a robustness test, they separately analyze a sample of single-stock dividend futures (dividend strips, claims to dividends to be paid out during a given calendar year), which allow varying duration characteristics while keeping maturity of cash flows fixed. Using monthly data for a broad sample of U.S. stocks starting August 1963, monthly data for global stocks starting July 1990, and annual data for 150 single-stock dividend futures with up to 5-year maturity starting January 2010, all through December 2018, they find that:

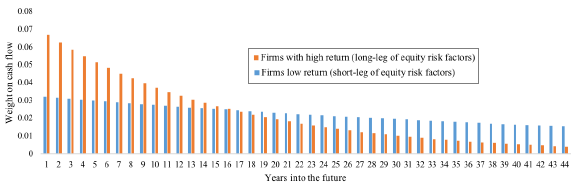

- Both in the U.S. and globally, firms with high (low) expected returns predicted by value, profitability, investment, low risk, idiosyncratic volatility and payout have short-term (long-term) cash flow durations, meaning that the market expects their cash flows to materialize mostly in the near (far) future. This commonality suggests that these characteristics predict returns because they predict duration (see the chart below).

- Quantitatively:

- A portfolio that is each month long (short) the tenth of U.S. stocks with the shortest (longest) durations has average gross monthly return 0.42%, monthly gross 1-factor (market) alpha 0.84% and market beta 0.90.

- For the U.S. duration factor specified above, average gross monthly return is -0.25%, monthly gross 1-factor (market) alpha is -0.55% and market beta is 0.61.

- For the global duration factor specified above, average gross monthly return is -0.27%, monthly gross 1-factor (market) alpha is -0.45% and market beta is 0.47.

- Average annual dividend growth rate for long-duration (short-duration) stocks, as defined for the U.S. duration factor, is 5.1% (1.2%).

- Of factors considered, only investment (profitability and investment) has a significant 2-factor (market, duration) alpha among U.S. (global) stocks.

- Analysis of dividend futures indicates that duration factor returns, and those of related risk factors, derive from cash flow duration and not other stock characteristics.

- The difference in book-to-market ratios between the long and short sides of the duration factor portfolio (slope of equity yield curve) predicts relative returns for long-duration and short-duration stocks, and therefore returns for the duration factor and most related factors. In addition, the overall average book-to-market ratio and the slope of the equity yield curve predict market returns.

The following chart, taken from the paper, compares present value of future annual cash flow distributions on average for firms in the long (orange) and short (blue) sides of value, profitability, investment, low risk, idiosyncratic volatility and payout factor portfolios. Relative cash flow magnitudes, or weights, are annual present values of cash flow divided by the sum of present values of all years. As shown, long (short) sides of risk factor portfolios tend to hold stocks with relatively high (low) near-term cash flows, meaning stocks with short (long) cash flow durations. Results are similar for risk factors treated separately.

In summary, evidence suggests that stocks with future cash flows concentrated in the near (far) term tend to outperform (underperform), and that this finding explains how several widely accepted equity factors work.

Cautions regarding findings include:

- Reported returns are gross, not net. Accounting for monthly portfolio reformation and shorting costs would reduce returns for all factors. Moreover, shorting may not always be feasible as specified. These costs/constraints may concentrate in specific duration sub-portfolios, such that net findings differ from gross findings.

- Estimation of the duration factor involves simplifications and approximations that may not work well out of sample.

- The duration factor estimation process is beyond the reach of most investors, who would bear fees for delegating to a fund manager.